Sailboat Insurance

Get sailboat insurance for as low as $100/year for a liability policy *.

We make getting sailboat insurance as simple as possible with fewer restrictions and more sailing freedom. We’ll insure almost any type, including vessels that don’t fit the textbook definition. Even if you race your sailboat, you can still get coverage from Progressive. Get a sailboat insurance quote online and get protected before you hit the water.

Do you need insurance for a sailboat?

Boat insurance is mandated in only a few states , but you’ll likely want to protect your sailboat against physical damage. And, in case you’re responsible for someone else’s injuries or damages while out on the water, boat liability coverage is important for all boaters. Get more information on your state’s boat insurance requirements .

How much does sailboat insurance cost?

At Progressive, sailboat insurance rates start at just $100/year for a liability policy. * Keep in mind, your sailboat type, boating history, and location will all factor into your price. Progressive’s many boat insurance discounts can help lower your price, including one for having more than one watercraft on your policy.

Learn more about the cost of boat insurance .

Sailboat insurance coverages

The best sailboat insurance policies will not only cover the basics, like liability, and comprehensive and collision coverage for your boat , but will also provide unique coverage options. Here are some of the special coverages Progressive offers to protect you and your sailboat:

No depreciation on partial losses

Progressive pays what it costs to return your vessel to its pre-accident condition or better. For example, let’s say your sail is damaged in a covered loss. It’s older and has a current market value of $350. But a brand new one costs $1,000. If we can’t repair it properly, we’ll pay to replace it with a new one. This coverage comes at no extra cost and extends to include rigging equipment, sails, electronics, and more.

Agreed value coverage

Sailboat values vary widely depending on model, customizations, age, and sometimes even vintage value. So, we offer agreed value coverage to make sure your sailboat is fully protected down to the last penny. If your sailboat is damaged beyond repair in a covered incident, we’ll pay you the value of the watercraft as agreed and not a depreciated amount.

Wreckage removal and fuel spills

Progressive covers the cost to remove your sunken sailboat from the water if removal is required by law. We’ll also pay to clean up a fuel spill, even if your boat doesn’t sink.

See all the available boat insurance coverages .

Tips for quoting sailboat insurance

- Know your sailboat’s year, make, and model for the most accurate quote

- Know your hull identification number; you’ll need it to start your policy

- We’ll sometimes ask about your sailboat’s hull length, material (usually fiberglass or aluminum), and propulsion type (inboard, outboard, or inboard/outboard)

- Completing a boater safety course may lower your sailboat insurance cost

- You’ll have the option to insure your sailboat’s trailer

We insure most sailboats and even cover racing usage, but we do have some limitations. Sailboats over 50 feet in length and valued at more than $500,000 aren't eligible for coverage. Sailboats that don't meet published U.S. Coast Guard standards and wood or steel hulls also aren't eligible.

Cover your sailboat with a leading boat insurer

Get a quote Or, call 1-855-347-3939

Monday - Friday: 8:00am to 8:00pm Eastern Time

Bundle and save an average of 5% on auto! Δ

- Auto + Home , Selected

- Auto + Condo , Selected

- Auto + Renters , Selected

Or, quote another product

- ATV/UTV , Selected

- Auto , Selected

- Autocycle , Selected

- Boat , Selected

- Car Loan Refinancing , Selected

- Car Shopping , Selected

- Classic Car , Selected

- Commercial , Selected

- Compact Tractor , Selected

- Condo , Selected

- Credit Building , Selected

- Debit Cards for Kids , Selected

- Dental , Selected

- E-bike , Selected

- Electronic Device , Selected

- Flood , Selected

- Golf Cart , Selected

- Health , Selected

- Homeowners , Selected

- Home Loans , Selected

- Home Security , Selected

- Home Warranty , Selected

- ID Theft , Selected

- Jewelry , Selected

- Life , Selected

- Mechanical Repair , Selected

- Mexico Auto , Selected

- Mexico Boat & Watercraft Insurance , Selected

- Mobile Home , Selected

- Mortgage Refinance , Selected

- Motorcycle , Selected

- Personal Loans , Selected

- Pet , Selected

- Renters , Selected

- RV/Trailer , Selected

- Segway , Selected

- Snowmobile , Selected

- Travel , Selected

- Umbrella , Selected

- Vision , Selected

- Wedding & Event , Selected

The Ultimate Guide to Sailboat Insurance

Key Takeaways

- Sailboat insurance is essential for financial and asset protection.

- Choosing the right policy involves understanding different coverage types.

- Expertise in sailing and insurance informs reliable policy selection.

Setting sail with peace of mind starts with the right sailboat insurance. Have you ever considered the "what-ifs" that come with owning a sailboat?

Sailboat insurance is not just a luxury; it's a necessity to safeguard both your financial investment and your passion for sailing. From liability coverage to protecting your hull and equipment, the right policy can cover a range of sailing scenarios.

As a sailor, you're no stranger to the unpredictability of the sea. That's why at "Life of Sailing," we pride ourselves on providing guidance rooted in extensive sailing knowledge and insurance expertise, ensuring you have the most reliable information to make informed decisions about your sailboat insurance needs.

Table of contents

Understanding Sailboat Insurance Coverage

Have you ever wondered what exactly sailboat insurance covers? Whether you’re a seasoned sailor or new to the nautical life, understanding the ins and outs of your policy is key to staying afloat financially if the unexpected happens.

What Does Sailboat Insurance Typically Include?

- Hull and Machinery : This is the crux of your insurance, covering damage to the actual boat and its essential components. Think of it as the health insurance for your vessel.

- Liability Coverage : If you’re ever found responsible for an accident, liability covers the costs associated with injury to others or damage to their property.

Here's What to Look For:

- Agreed Value vs. Actual Cash Value : Agreed value policies cover the boat at the value you and the insurer decide upon, while actual cash value policies factor in depreciation.

- Deductibles : Typically, a percentage of the insured value, deductibles can vary widely. A higher deductible can lower your premiums, but you’ll need to cover more out-of-pocket if an incident occurs.

Remember, the finer details of what’s covered can range significantly between policies. It’s important to compare quotes and understand the differences in coverage options. Always read the fine print; it’ll give you the clearest picture of what protections you're getting for your investment. And when you’re out there sailing, feeling the wind at your back, you’ll rest easier knowing your sailboat insurance has you covered.

Got specific questions about your policy? It’s always best to talk directly with your insurance provider to ensure you have the coverage that fits your sailing lifestyle. Stay shipshape by keeping informed, and enjoy the peace of mind that comes with a well-chosen sailboat insurance plan. Happy sailing!

Liability Coverage for Sailboats

Have you ever considered what would happen if your sailboat accidentally caused harm? It's not the most pleasant thought, but it's a scenario where liability insurance becomes vital. This type of coverage is designed to protect you from financial loss if you're held responsible for injury or damage to others while using your sailboat.

Now, what does liability coverage typically include ? Primarily, there are two main components:

- Property Damage: If your sailboat damages someone else's property, like another boat or a dock, liability insurance helps cover the repair costs.

- Bodily Injury: Should an accident occur resulting in injury to another person, this part of the insurance will help cover their medical expenses.

Remember, accidents can happen even to the most experienced sailors. During a race or a casual sail, conditions can change, or unexpected maneuvers could lead to a collision. The peace of mind that liability insurance offers is, therefore, invaluable.

When considering insurance options, it's important to note that premiums vary . They can account for anywhere from 1% to 5% of your sailboat's value . So, for a $200,000 sailboat, you could be looking at an annual cost from $2,000 to $10,000, depending on various factors including your sailing area and the insurance company's policy.

Don't let uncertainty sway you from enjoying your time on the water. Take the proactive step to insure yourself against potential liability. It's a small price to pay for the security it provides. Want to navigate these waters with more confidence? Dive into the variety of sailboat insurance options available. After all, your freedom to sail comes with the responsibility to shield yourself and others from unforeseen events.

Hull and Equipment Coverage

When you're out there sailing, the last thing you want to worry about is the financial hit you'd take if your boat was damaged. That's where hull and equipment coverage steps in. Have you ever considered what it actually does for you?

- Physical Damage Protection : This is the core of hull and equipment coverage. It’s there to look after the heart of your boat—the hull, sails, and machinery.

- Collision and Grounding : Picture your sailboat having an unexpected encounter with a submerged object. Coverage here can save you from out-of-pocket repair costs.

- Weather Hazards : If a squall sneaks up on your peaceful sail, rest assured that the right policy can help shoulder the cost of damage repairs.

How does this reflect in real life , you ask? Well, if a violent storm leaves your sails in tatters, hull and equipment coverage typically helps pay for those repair bills so you can set sail again quickly.

It’s not just natural events either. Theft and vandalism are unpleasant realities, but comprehensive hull and equipment coverage offers peace of mind, even when you're not around to watch over your beloved boat.

It's vital to remember that costs can vary. For a yacht worth $100,000, you might spend around $2,500 annually to keep it insured. Naturally, the higher the value of your sailboat, the more it'll cost to insure — typically between 1% and 5% of the vessel’s value.

Remember, the sea can be unpredictable, and having the right insurance in place is just as important as your navigation skills. Stay safe, and sail with the knowledge that your floating investment is well protected against the whims of Poseidon.

Agreed Value vs. Actual Cash Value Policies

When shopping for sailboat insurance, have you considered how different policies handle the valuation of your boat? It's crucial to understand two main types: Agreed Value and Actual Cash Value policies.

Agreed Value Policies :

- Settlement : Based on a value you and the insurer agree upon when you take out the policy.

- Depreciation : Not factored in the payout for a covered loss.

- Premiums : Tend to be higher due to the more comprehensive coverage.

Actual Cash Value Policies :

- Settlement : Reflects the boat's current market value at the time of the loss, considering depreciation.

- Depreciation : Reduces the payout amount over time as the boat ages.

- Premiums : Generally lower since the potential payout decreases as the boat depreciates.

Your choice depends on how you value peace of mind versus upfront savings. Would you prefer to pay a bit more now for a bigger safety net with an Agreed Value policy? Or are you willing to risk a lower payout down the line to save on premiums now with an Actual Cash Value policy?

Remember, no policy is superior in every situation—it's about what fits your financial planning and risk tolerance. Insuring your vessel is about balancing cost versus potential benefits, and it's vital to make an informed decision to navigate the waters ahead with confidence.

Specialized Coverage for Offshore and Bluewater Sailing

When you're braving the vastness of the ocean, are you confident that your sailboat insurance has you covered? Whether it's the challenge of offshore sailing or the long hauls of bluewater voyages, the risks you encounter on the open sea are unique, and so is the insurance you need.

What should you look for in specialized coverage?

- Navigation Limits: Many policies define where you can sail. Are you covered beyond coastal waters?

- Weather Conditions: High seas and strong winds are common. Does your policy cover storm damage?

- Search and Rescue Operations: If disaster strikes, you want to ensure that the cost of a potential rescue is included.

- Medical Coverage: Remote sailing might require medical evacuation which can be expensive without proper insurance.

Did you know that sailboats equipped with advanced safety features might be eligible for insurance discounts? It's also vital to consider how often you use your sailboat . A vessel moored safely in a harbor most of the year might not require as extensive coverage as one frequently crossing oceans.

Racing and Regattas: If racing is your passion, check for policies catering to the increased risks associated with competitive sailing.

Here's something to ponder: How does the insurance industry view your exciting plans for bluewater adventures? An insurance broker might package your sailing profile and pitch it to various companies — the goal is to find the one that suits your specific needs without breaking the bank.

Remember, offshore and bluewater sailing insurance is more comprehensive and, as a result, often costlier. But can you really put a price tag on peace of mind when you're far from shore? Make sure your policy reflects the value of your vessel and the potential risks you'll face at sea.

Cruising the blue expanses is about freedom and adventure. Your sailboat insurance should be a safety net that empowers rather than restricts your seafaring dreams. Check options, compare quotes, and sail secure in the knowledge that you are well-protected on your oceanic journeys.

Coverage for Racing Sailboats

Have you ever wondered about the specific needs of insuring a sailboat that’s racing-bound? It’s a unique world within the nautical sphere and requires a special kind of attention when it comes to insurance.

First things first, Hull Insurance is paramount. This type of coverage is designed to protect your sailboat from physical damage due to accidents such as collisions or running aground in the heat of a race. Picture this, you’re at the helm during a regatta, the competition is fierce, and an unforeseeable incident occurs. That’s when hull insurance becomes your safety net.

Liability Insurance takes on a role of equal importance. When a mishap happens and someone else's property is damaged or worse, if there are injuries, liability insurance steps in. Racing increases the risk, and the sea doesn’t play favorites, so being covered for such liabilities can save you from a financial squall.

Considering the risks, here's what you can expect:

- Increased Premiums : High-risk activities like racing can raise insurance costs. Think of it as the price for an extra peace of mind.

- Experience Matters : Seasoned sailors might benefit from lower premiums. It's a nod to your proficiency and the reduced risk you pose.

- Choose Wisely : More coverage will cost more, but think about what you might need. Collision damage? Bodily injury liability? It's a personal choice with universal implications.

In terms of costs, generally, premiums are a percentage of your vessel’s value, typically ranging from 1% to 5%. So, if you've got a $50,000 gem, your annual premium might run between $500 and $1,000. It might seem steep, but consider the alternative and it quickly seems like a worthy investment in your sailing passion.

Remember, every policy and provider is different. Delving into details and finding the right fit for you and your racing sailboat takes careful consideration, but it's a course well worth navigating. Stay safe and may the winds be ever in your favor!

Navigational Limits in Sailboat Insurance

Have you ever wondered about the invisible boundaries that may exist on your sailing adventures? When it comes to sailboat insurance, navigational limits signify a critical aspect. Essentially, these are defined zones within which your sailboat is covered by insurance.

Let's dissect this, shall we? If your dreams have you sailing across vast oceans, you'll want to ensure your policy doesn't confine you to coastal waters. Some policies may restrict your navigation to a certain distance from the shoreline. Why does this matter? Venturing past these limits without proper coverage could leave you exposed to financial risks.

Consider these vital points:

- Know Your Boundaries: Familiarize yourself with the specified areas your policy covers.

- Check for Restrictions: Some waters may be off-limits—knowing these details can save headaches (and unexpected costs) later on.

- Be Proactive with Coverage: If your sailing plans include areas beyond standard limits, additional coverage may be necessary.

Remember the numbers mentioned earlier? They are not just abstract figures; they represent your peace of mind. An insurance company might offer a 25% discount when you bundle your boat insurance, including enticing add-ons like coverage for fishing equipment (up to $1,000 ), personal effects ( $3,000 ), and towing ( $500 ).

Understanding your policy's navigational limits is not just about compliance; it's about ensuring you can sail with confidence, knowing you're covered. So before you let the wind fill your sails, take a moment to review your policy's map. After all, the open seas are calling, but they're much more inviting when you know you're within your navigational confines.

Personal Effects and Crew Coverage

Have you ever thought about what would happen to your personal belongings during a sailing adventure? Personal effects coverage is here to ease your mind. This portion of your sailboat insurance is designed to protect items you bring on board—think clothing, electronics, or fishing gear.

Here's what you need to know:

- Coverage Limits : Policies typically offer a certain amount for personal effects. For instance, a professional fisherman policy may offer up to $5,000 for fishing equipment.

- Claim Basis : In case of a loss, replacements are often valued on a cost coverage basis. You could see up to $10,000 for personal effects under such scenarios.

- Exclusions : As savvy as you are, it’s important to read the fine print because wear and tear or heavy winds causing damage to rigging, for example, might not be covered.

When it comes to the crew, insurance steps in to offer protection, too. Whether it’s a paid crew or a group of friends, you'll want to make sure everyone is covered in case of an accident or injury. Coverage for the crew is as crucial as the safeguarding of your personal effects. This ensures a worry-free sailing experience for everyone on board.

Why is this so important? Because nothing dampens the spirits like an unforeseen incident that isn't covered. Sail with the peace of mind knowing both your belongings and your crew are secured under the umbrella of your carefully chosen sailboat insurance policy.

Have you checked your policy recently? Take a moment to ensure your coverages are shipshape! After all, the tranquility of the deep blue is best enjoyed with the confidence that you’re well protected.

Weather and Storm-Related Damage Coverage

Have you ever thought about what might happen to your beloved sailboat during a severe thunderstorm or an unforeseen squall? That's where weather and storm-related damage coverage comes in as a critical part of your sailboat insurance policy. This coverage is your financial safeguard against the volatile temperament of the sea and the sky.

What does it typically include? Usually, this coverage ensures repair or replacement costs for your sailboat in events such as:

- Ice and snow (in some cases)

Imagine the strength of a sudden gust tearing at your sails or a rogue wave testing your hull's limits. It's in these moments that having robust insurance coverage could mean the difference between a quick fix and a devastating loss.

What should you check for in a policy? It's key to scrutinize the details:

- Ensure the policy mentions specific storm scenarios.

- Verify coverage limits align with your sailboat's value.

- Confirm whether it includes towing or assistance if you get stranded.

Remember, the lowest premium might not always give you the comprehensive protection your sailboat deserves. The peace of mind knowing your floating sanctuary can withstand nature's tantrums? That's priceless.

It's not just about repairing the hull or the sails; it’s about the ability to set sail again as swiftly as possible after a storm. So, take a moment to review your current policy or consider these factors when shopping for new coverage. Stay safe and buoyant, and let your insurance handle the tempests.

How to Choose the Right Sailboat Insurance Policy

When searching for the ideal sailboat insurance, what's your top priority? Is it comprehensive coverage, or are you more concerned with a budget-friendly rate? Let's navigate these waters together to find a policy that suits your unique needs.

Firstly, consider liability coverage . This is the bedrock of any sailboat insurance policy. Ask yourself, how much protection do you need? Most experts suggest a minimum of $1 million in liability to cover any accidents or damages you might be responsible for.

Next, turn your eyes towards policy types . You'll typically encounter two: Agreed Value and Actual Cash Value . The Agreed Value policy covers the boat based on a value agreed upon by you and the insurer, ideal for minimizing depreciation concerns. On the other hand, an Actual Cash Value policy considers depreciation in the event of a loss.

Don't overlook the value of shopping around . It’s crucial to:

- Compare quotes from multiple providers

- Check on customer service reputacies

- Understand the fine print on deductibles

Assess your needs for additional coverage options as well. Consider whether you'll require towing insurance, or if you’re keen on extra coverage that includes personal items or fishing gear.

Remember, a good sailboat insurance policy is more than just a price point; it's a safety net that lets you sail with peace of mind. Take the time to weigh options, coverages, and costs to ensure that your policy is as tailored to your sailing lifestyle as your boat is to the sea.

Daniel Wade

I've personally had thousands of questions about sailing and sailboats over the years. As I learn and experience sailing, and the community, I share the answers that work and make sense to me, here on Life of Sailing.

by this author

Trending Now

Advanced Sail Handling Systems: Innovations in Hoisting and Reefing

Dufour Sailboats Guide & Common Problems

Best Sailing Documentaries

Best Virtual Sailing Simulators and Games

What Does "Sailing By The Lee" Mean?

Best Sailing Duffle Bags: Top Picks For Boat Travel

The Best Sailing Schools And Programs: Reviews & Ratings

Affordable Sailboats You Can Build at Home

Best Small Sailboat Ornaments

Best Small Sailboats With Standing Headroom

Get The Best Sailing Content

Top Rated Posts

Lifeofsailing.com is a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for sites to earn advertising fees by advertising and linking to Amazon. This site also participates in other affiliate programs and is compensated for referring traffic and business to these companies.

© 2024 Life of Sailing Email: [email protected] Address: 11816 Inwood Rd #3024 Dallas, TX 75244 Disclaimer Privacy Policy

- Agent Directory

- Company Directory

Find an Independent Agent

- Get Matched with an Agent

- Agent Directory by State

Find an Insurance Company

- Get Matched with a Company

- Company Directory by State

What type of insurance do you need?

- Business Insurance

- Home, Auto & Personal Insurance

- Life & Annuities

By Coverage Type

- Commercial Auto Insurance

- Professional Liability Insurance

- Small Business Insurance

- Business Umbrella Insurance

- Workers' Compensation Insurance

- Commercial Property Insurance

- Business Owners Policy

- Builders Risk Insurance

- Cyber Liability Insurance

- Surety Business Bonds

- Inland Marine Insurance

- Employers Liability Insurance

- Employment Practices Liability Insurance

- Environmental Liability Insurance

- Errors and Omissions Insurance

- Insurance Coverage & Advice by State

- See more ...

By Business Type

- Retail Store

- Agriculture & Forestry

- Construction

- Manufacturing

- Wholesale Trade

- Retail Trade

- Transportation & Warehousing

- Information Industry

- Finance & Insurance

- Real Estate

- Scientific & Technical Services

Auto & Vehicle Insurance

- Car Insurance

- Motorcycle Insurance

- Boat Insurance

- RV / Motorhome Insurance

- ATV Insurance

- Snowmobile Insurance

- Personal Watercraft Insurance

- Collectible Auto Insurance

- Umbrella Insurance

Home & Property Insurance

- Homeowners Insurance

- Condo Insurance

- Farm Insurance

- Landlord Insurance

- Renters Insurance

- Mobile Home Insurance

- Contents Insurance

- Vacant Land Insurance

- Flood Insurance

Other Insurance

- Life Insurance

- Long Term Care Insurance

- Disability Insurance

- Health Insurance

- Special Event Insurance

- Short-term / Sharing Insurance

Insurance Solutions & Resources

- Compare Car Insurance

- Compare Home Insurance

We'll Help You Find the Best Boat Insurance in Minutes

Our nationwide network of local independent agents is ready to help you find the perfect coverage at the best rate..

TrustedChoice.com Article

How will this quote help me?

Your quote is based on several common factors to give you a clear picture of the cost you can expect, though an independent agent can shop around and maybe even improve your rate!

NOTE: This quote is not final, though we did work with professional actuaries to help get you a ballpark figure to get started.

Do you have to have boat insurance on a boat?

Only two states require boat insurance by law, but there are a few instances where you may need it. If you dock your boat at a marina, they may require some form of coverage in order to protect their business. Also, if you finance your boat, nearly every lender will require coverage to protect their investment; use our list of the best boat insurance companies as a starting point.

Other than that, you should always have at least liability coverage on your boat to protect yourself against lawsuit costs if you cause bodily injury or property damage to another party. Property coverage is optional, but again, the more comprehensive your coverage, the better it can protect you.

How much is boat insurance?

The cost of any boat insurance policy depends on a number of factors, including your boat's size, value, and horsepower. Boat insurance policies can range from the low hundreds to tens of thousands of dollars annually, depending on what kind of coverage you need.

Do I need to insure my boat trailer?

Insuring your boat trailer is always a safe bet. Though your boat trailer may be protected by your home or car insurance policy, you can also add coverage to your boat insurance for your trailer. It's best to talk to your independent insurance agent about your boat, the trailer, and how you use it to determine the right coverage amount.

Does boat insurance cover passengers?

If your policy includes medical payments coverage, it will cover injuries to your passengers if you get into an accident. Medical payments coverage is an important option because just one accident can cause injuries that are extremely costly to treat.

Does boat insurance cover theft?

Typically, yes. But it's important to review your specific boat insurance policy with your independent insurance agent to make sure. Every carrier and every policy is different, but the more you know about your own policy, the better it will help protect you.

Does boat insurance cover hurricanes?

In most cases, yes, your boat will be covered against hurricane damage. But, as with any other natural disaster or unexpected event, you'll want to double-check your policy.

Does boat insurance cover engine damage?

No, boat insurance often excludes defective machinery or maintenance costs. Wear and tear is a natural outcome of use and not covered by your policy.

What is the cost difference in insuring different kinds of boats?

The size and value of your boat are two of the most impactful features on the cost of your coverage. Insurance for a $20,000 boat can cost an average of only $300 per year, while insuring a $2 million yacht can cost as much as $30,000 per year.

Does boat insurance cover me if I hit a rock?

If you have collision coverage on your boat insurance, you should be covered for the cost of repairs if you hit a rock.

Does boat insurance cover a blown engine?

In certain cases, boat insurance may cover a blown engine if the disaster was due to a listed peril. For example, ice and freeze damage to engines is typically covered. However, blown engines due to the owner's negligence are not covered.

BOAT INSURANCE

Find the perfect agent to shop multiple insurance companies on your behalf, saving you time and money.

Boat owners can experience a lot of joy and excitement brought by their watercraft, but they also have to anticipate potentially costly disasters ahead of time. Aside from accidents on the water, your boat is also vulnerable to theft, vandalism, flood damage, and more. That's what makes having boat insurance so critical.

An independent insurance agent can help protect your vessel with the right boat insurance long before you ever need to file a claim. But first, here's some boat insurance 101.

What Is Boat Insurance?

Boat insurance is designed to cover boat owners and their watercraft in case of many different disasters, including accidents, fire, and more. These policies are made to protect boats that have motors, like yachts, pontoon boats, etc., but they don't cover kayaks or canoes. Boat insurance is important because homeowners insurance doesn't provide enough coverage on its own for most watercraft.

Do You Have to Have Insurance on a Boat?

Only two states actually require boat insurance coverage , but there are a few situations where you may need it. First, if you dock your boat at a marina, they may require some form of coverage in order to protect their business. Second, if you financed your boat, nearly every lender will require coverage to protect their investment.

Further, there are certain types of boats that are more important to insure than others due to their value, risk level, and more. Here's a handy guide to whether you need boat insurance for your vessel.

| Boats that need insurance: | Boats that don't need insurance: |

|---|---|

| Boats that have 25 horsepower or greater | Boats with less than 25 horsepower |

| Yachts | Small engine boats |

| Large sailboats | Small sailboats |

| WaveRunners | Canoes |

| Jet boats | Inexpensive boats |

Most often, boat insurance is purchased for:

- Utility boats

- Fishing boats

- Pontoon boats

Despite all the fun to be had with a boat, accidents and disasters can happen. The easiest way to protect yourself and others, and get you back on the lake after a situation, is with the right boat insurance.

Best Boat Insurance Companies

While many carriers offer boat insurance, it's helpful to know some of the top names in the industry before you start shopping. Here are a few of our highest-recommended boat insurance companies.

| Top Boat Insurance Companies | Star Rating |

|---|---|

An independent insurance agent can help you get the right boat insurance policy for you from one of these top-rated carriers, or another that best meets your needs.

Do I Need Boat Insurance?

The only two states that require boat insurance by law are Utah and Arkansas. Boat owners in these states must have coverage for personal watercraft or for powerboats with 50 horsepower or greater. Otherwise, if you live elsewhere and your boat is designated for personal use, you're not technically required to have insurance for it.

However, if you lease or otherwise finance your boat, you're likely to be required by your lender to carry boat insurance, and often you'll need both collision and comprehensive coverage. When docking your boat, you're often also required by the marina to have liability coverage. However, with boating accidents being so common, it's important to at least consider getting boat insurance for yourself.

Most Common Types of Boating Accidents

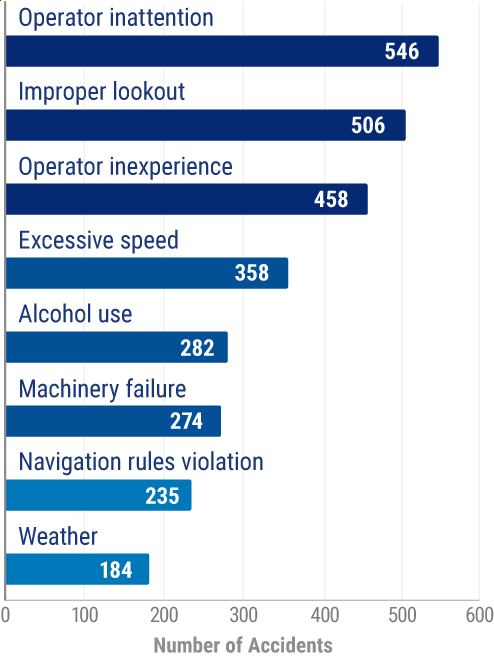

Notice that the top five causes of boating accidents are due to human error, such as inattention, improper lookout, alcohol use, and inexperience. Since you can't often blame the boat for an accident or other disaster, it's even more critical to ensure that your vessel is covered with the right insurance.

How Much Is Boat Insurance?

The average annual cost of boat insurance ranges from $200 to $500 depending on the type of boat you have and other factors. It also depends on which types of coverage you need, and how much coverage you need. For folks who only purchase liability coverage, you might pay less than $100 annually.

Often, you can expect the annual cost of your boat insurance to be about 1.5% of the value of your boat. For example:

- $20,000 boats cost about $300 annually to insure

- $50,000 boats cost about $750 annually to insure

- $100,000 boats cost about $1,500 annually to insure

- $500,000 boats cost about $7,500 annually to insure

- $2 million boats, like yachts, cost about $30,000 annually to insure

- If you are looking for boat insurance for older boats , costs will vary significantly

The cost of your boat insurance might not be this simple to figure out, though. For more help calculating the cost of your premiums, use our boat insurance calculator or reach out to an independent insurance agent for a quote.

What Factors Influence Boat Insurance Costs?

Like any form of coverage, boat insurance costs depend on several factors, including:

The make, model, and value of your boat

Your boat's make, model, and value influence the cost of boat insurance because the more expensive your boat is to replace or repair, the more expensive your coverage must be. If your boat is valued at less than $20,000, you will pay approximately the average cost in your state. If your boat is valued above $500,000, you might pay up to 2,250% of the average cost in your state.

Your boat's length

Boat insurance costs also depend on the length of your boat. Be prepared to pay about 66% more for your coverage if your boat is 100 feet or longer, but if your boat is less than 20 feet, you may pay 12% less than average rates in your state.

Your boating records

If you've had six or more accidents or violations within the past five years, you can expect a 90% increase in your boat insurance premiums. However, if you've had no incidents during this time, you can expect a 40% decrease in your boat insurance premiums.

Your location

Boat insurance premiums vary considerably by the state you live in. Many factors can influence insurance costs by location, including crime rates, property values, and more.

How you use your boat

Depending on the risk level of the activities you perform with or on your boat, your premiums may be higher or lower. Using a boat for towing can be riskier than using it just for fishing, so boats used for fishing would be likely to have lower boat insurance premiums.

How often you use your boat

Similar to auto insurance, how often you use your boat can also influence your boat insurance rates, because the more you use it, the more likely an accident or other disaster is to occur. For boats that only get taken out on occasion, premiums for boat insurance can be much lower than those that get used daily on the water.

An independent insurance agent can provide you with quotes for boat insurance from several carriers near you.

What Discounts on Boat Insurance Exist?

Many insurance companies offer several discounts on boat insurance to help lower the cost of your premiums. Here are just a few common boat insurance discounts:

- Boater safety course discount: You might qualify for a discount on boat insurance if you complete a state-approved boater safety course.

- Bundling discount: Many insurance companies offer discounts if you bundle your boat insurance with another policy through them, such as auto insurance or home insurance.

- Paid-in-full discount: Many insurance companies lower your overall premium if you pay for your entire year's worth of coverage up-front.

- Homeowners discount: Some insurance companies even offer discounts on your boat insurance just for being a homeowner, even if your coverage is not through the same carrier.

- Clean boating history discount: You're likely to be rewarded with a boat insurance discount by many carriers if you've maintained a clean, accident and violation-free boating record.

Your independent insurance agent is a great ally in helping you find any discounts you may qualify for on boat insurance, no matter which carrier you go through.

What Does Boat Insurance Cover?

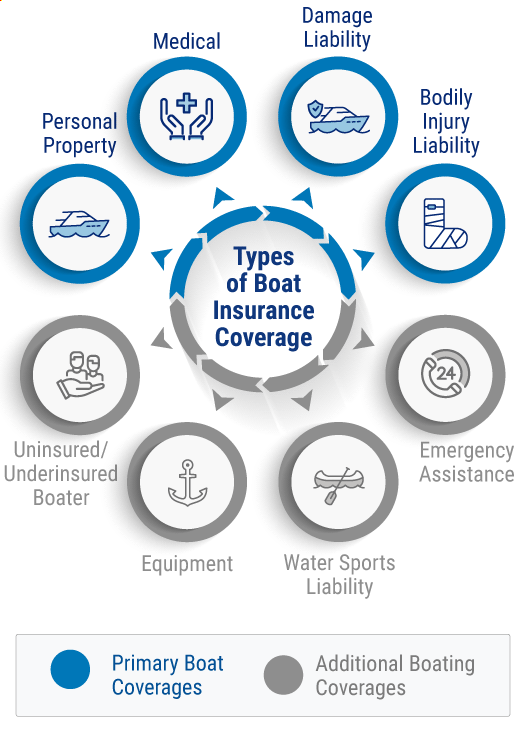

Boat insurance provides a lot of important protection, not only for your boat, but also for you, your passengers, and everyone else on the water or at the marina. Boat insurance typically includes the following primary coverages:

- Personal property damage: Provides reimbursement for your boat, trailer, and engine if they're damaged by a covered peril like vandalism, fire, etc.

- Medical payments: Provides reimbursement for treatment of injuries to you and your passengers who get hurt by your boat or while on your boat.

- Property damage liability: Provides reimbursement of property damage lawsuit costs from third parties due to your boat.

- Bodily injury liability: Provides reimbursement for injuries to anyone who gets physically harmed by your boat.

The following coverages are commonly added to standard boat insurance:

- Uninsured/underinsured boaters: Covers injury expenses if the other boater is responsible but doesn’t have any, or enough, insurance to cover your expenses.

- Fishing equipment: Sometimes included, you'll be reimbursed up to a certain limit, like $1,000.

- Water sports liability: Some policies exclude water sports from your liability coverage and some don't, but this coverage is important if you'll be doing stunts, etc.

- Emergency assistance on the water: Also known as boat towing insurance, coverage provides water towing and other assistance services through a maritime dispatch center.

- Roadside assistance for your boat and trailer: This coverage guarantees that the towing company will take your vehicle, boat, and trailer to the nearest facility if you get stranded on the road.

If you have questions or concerns based on your plans on the water, it's best to talk to your independent insurance agent. They can help you find and increase coverage so that it works best for you.

Important Additional Coverages for Boats

Beyond the common coverages, it's always recommended to consider additional coverages that can help tailor the policy to your unique risks. Here are several optional boat insurance coverages worth considering:

- Collision: Provides coverage for collisions between your watercraft and other vessels or objects. You're also covered if your boat capsizes on the water.

- Comprehensive: Covers other disasters beyond collision like theft, vandalism, storm damage, and more.

- Hurricane hauling services: Covers the cost of moving your watercraft out of the county where it's docked in case of emergency.

- Personal property coverage: Personal property is usually covered under your homeowners policy, even when the boat isn't at your house. However, your deductible is often higher, so you can add personal property coverage on your boat policy to avoid a homeowners claim.

- Wreckage and fuel removal: Reimburses cost to recover or destroy wreckage and fuel if you get in an accident.

- Replacement cost or agreed value: Newer and more expensive boats can be insured for agreed value, which means you'll recover the full amount you paid for it, without depreciation.

- Pet coverage: If you boat with a pet on board, this provides up to $1,000 towards veterinarian fees if they're injured on the boat.

An independent insurance agent can recommend the additional boat insurance coverages that are a good match for you.

What Is Boat Rental Insurance Coverage?

Boat rental insurance is often required by boat rental companies to protect against lawsuits that may arise when you operate a rented vessel. If a third party sues you for claims of bodily injury or property damage when you're operating a rented boat and you don't have boat rental insurance, you'll have to pay out of pocket for your defense and settlement costs.

What Boat Insurance Will Pay For

Before settling on a boat insurance policy, it's important to understand just what it will reimburse you for and what it won't. Here's a breakdown for further clarification.

| Boat insurance pays for: | Boat insurance won't pay for: |

|---|---|

| Physical damage due to covered causes like theft, fire, etc. | Maintenance costs. |

| Physical damage to the boat and anchors or other equipment. | Machinery damage or defective equipment and boat components. |

| Medical expenses for those injured on or by your boat. | Medical expenses relating to shark bite injuries. |

| Property damage to others caused by your boat. | Property damage caused by insect infestations, mold, barnacles, etc. |

| Liability issues that arise when someone else drives your boat with permission. | Intentional harm caused to others with your boat. |

If you still have questions about what's covered or not covered by boat insurance, your independent insurance agent can help.

Finding Discounts and Savings on Boat Insurance

Fortunately, there are typically several discounts available for boat insurance. While options vary by insurance company, here are some common discounts:

- No claims history discount: If you've never filed a claim on your boat insurance, your carrier is likely to reward you with a discount over time.

- Diesel-powered boat discount: Some boat insurance companies offer discounts for watercraft with diesel-powered engines.

- Safety course discount: You might be eligible to receive a discount on your boat insurance if you complete a state-approved safety course.

- Bundling discount: Often you can save money on boat insurance if you bundle it with another type of coverage, such as home insurance, through the same carrier.

An independent insurance agent is your greatest ally when it comes to finding discounts on boat insurance.

Why Choose an Independent Insurance Agent?

Independent insurance agents simplify the process by shopping and comparing insurance quotes for you. Not only that, but they’ll also cut through the jargon and clarify the fine print so you know exactly what you’re getting.

Independent insurance agents also have access to multiple insurance companies, ultimately finding you the best boat insurance, accessibility, and competitive pricing while working for you.

More Choices

Our independent insurance agents work for you, not the insurance companies. That means you always get the best coverage options to choose from.

Better Prices

When you have options from multiple companies, it's easier to find the best coverage at the right price, at no extra cost to you.

Local Services

There's an independent agent in every city who always understands the insurance coverage you need most based on local laws and needs that apply to you.

What our customers are saying

Work Done For Me

I looked at different individual companies, but it was so time-consuming to fill out each individual application and keep track of them all. Trusted Choice got back to me quickly and gave me an option that worked. I ended up with Travelers, which has a great price. The online process was pretty easy. Plus, they did the legwork for me. It was a great experience.

Multiple Options

I tried finding insurance myself but I wasn't coming up with very much. I contacted Trusted Choice and they looked at various options and presented it to me. Everything with the agent went very smoothly... He knew exactly what we wanted and searched accordingly. I was able to choose the one that I thought was best so it worked out for me. I'm happy that I did it that way.

I needed insurance for the home that I was buying and based on the pricing, I went with Trusted Choice. The process was all done online and I didn't really have to do too much. The website was also easy to use and navigate and it was not overly intimidating. Everybody that I've dealt with also seemed good and professional. It was a positive experience.

One-On-One Attention

Every year I search for insurance to make sure that I’m getting the best bang for my dollar. I went with an independent agent because if I go through them, I get that one-on-one instead of being just a number.... The experience was great.

Really Helpful

TrustedChoice.com was real helpful when I needed to get insurance. The agent gave me the basics of what I'd be getting if I got insurance with them.

Multiple Agents

I needed a different independent agent to get insurance and I went with Trusted Choice. Their website was helpful in connecting me to two or three other agents that I was able to speak to. Their site did what I needed.

More Coverage

Trusted Choice's online process is super easy. They pulled most of the information and I ended up going with one of their recommendations. Aside from them, everybody else was too expensive. Plus, the Trusted Choice agent offered more coverage.

Great Match

Everybody at TrustedChoice.com was helpful and pleasant. They set us up with a great match and gave us our best option and price.

Best Coverage and Rates

I did a lot of searching for insurance and I went with a Trusted Choice agent because they provided the best rates and coverage. I haven't had a claim but I know I'm covered and that's good news. I would recommend Trusted Choice.

IMAGES

COMMENTS

At Progressive, sailboat insurance rates start at just $100/year for a liability policy. * Keep in mind, your sailboat type, boating history, and location will all factor into your price. Progressive’s many boat insurance discounts can help lower your price, including one for having more than one watercraft on your policy. Learn more about ...

As long as your seafaring adventures are within 75 miles of the U.S. or Canadian coastlines, Progressive will offer a solid and reliable plan for your boat insurance. The company's customizable boat insurance is a cherry on the cake as it makes it a lot easier for boaters to bundle their policies and work within their budgets.

Boat insurance is crucial for protecting your investment, whether you're navigating lakes, rivers, or ocean waters across the United States. With GEICO for your boat and BoatUS–the nation's largest group of recreational boat owners–you're backed by a partnership with over 50 years of experience in making boating safer and more enjoyable.

Jan 2, 2024 · The Seven Best Boat Insurance Companies for 2024. To help you get an idea of the available coverage options you may need, this article covers some of the best boat insurance companies and policies. They are: Best Boat Insurance Overall: Progressive; Best Boat Insurance for Value: Progressive; Best Boat Insurance for Member Benefits: Ahoy! Insurance

An insurance company might offer a 25% discount when you bundle your boat insurance, including enticing add-ons like coverage for fishing equipment (up to $1,000), personal effects ($3,000), and towing ($500).

Dec 4, 2024 · Bundling discount: Many insurance companies offer discounts if you bundle your boat insurance with another policy through them, such as auto insurance or home insurance. Paid-in-full discount: Many insurance companies lower your overall premium if you pay for your entire year's worth of coverage up-front.