Yacht Insurance

Choose the best yacht insurance.

"It is not the ship so much as the skillful sailing that assures the prosperous voyage"

- George William Curtis

But we say, the prosperous voyage also requires protection against unforeseen perils or damages including the possible assistance in rescue.

Whether it is a hull or the vessel as a whole, we have our expert team who can help you with the right policy that meets all your requirement that ensures a relaxed sail.

Get your free quote today!

Which insurance is best for you?

A yacht is a significant investment, with yacht insurance providing comprehensive protection in the event of damage. Policies cover yachts and boats of all sizes, even if they are docked when the damage occurs.

Professional Indemnity

Insuring your commercial business against errors and omissions, Professional indemnity policies help protect a broad range of professionals from potential financial losses incurred due to errors or omissions committed during the conduct of business.

Would you like to get a quote? Fill in your contact details and our representative will get in touch with you soon.

Why choose bestinsurance.ae.

With Best Insurance, you enjoy fast turnaround times, competitive costs from quality insurers and hassle-free experience.

Want us to call you back? Fill in your contact details and our representative will get in touch with you soon.

- Third Party - It protects any person that you might injure while you are driving. It is not an alternative to taking out a motor policy to cover your financial liabilities, such as damage to another vehicle or property, or your own vehicle

- Comprehensive – covers damage to your own vehicle and other people’s property, as well as theft and some other risks, plus legal costs

- The type of cover and excess you have chosen, including any options you have added

- The location where the car is stored overnight or during the day

- The age of the driver

- The driving record and insurance history of the drivers

- The type of vehicle being insured (make, model, year)

- The intended use of the vehicle (such as private or commercial use)

- Whether you have nominated a market or agreed value for your vehicle

- Modifications to the vehicle

A no-claims discount is given to drivers following a period when no claims are made on your insurance policy

Need any help!

For over 31 years, we have been helping companies & individuals with the best insurance solutions for them. Get in touch with us today to benefit from the variety of products & deals.

- Sultanate of Oman

- Digital Services

- Personal Accident

- Trade Credit

- Sukoon Takaful

- Make a Claim

- Customer Satisfaction

Privilege Yacht

- Back to Home

- Comprehensive cover for all yacht types

- Customised solutions for affluent customers

- Protection and indemnity cover

- Seasoned underwriting and claims staff

Product Overview

Our Yacht Insurance product is developed keeping your convenience at its core. With more than 45 years of expertise, our comprehensive cover for yachts, pleasure craft and boats remains a top choice for our high net-worth and affluent customers. Irrespective of the make or model of your yacht, we offer comprehensive protection from physical loss or damage, personal accidents involving crew or passengers and a host of optional covers tailored just for you. What’s more, we have a dedicated, in-house claims team along with international reinsurer partnerships to ensure a single point of contact and fast claims pay-out. Our aim is to protect and ensure every adventure and leisure trip you take to the ocean.

Why Choose Sukoon?

Market leader.

Insuring yachts, boats and jetskis for 45 years

Dedicated Teams

Inhouse, specialised claims and underwriting teams

Comprehensive Cover

All plans tailored and underwritten to your specific needs

Privilege Club

Additional benefits, discounts, centralised customer service and more

What's Covered

Our clientele, how to get insured.

Apply by Phone

Call us at 800 64272 for more information and to enrol over the phone.

Apply by Email

Apply in Person

Request a call back from one of our insurance experts.

Product resources.

I bought yacht insurance, but I want to know if my jet ski is covered?

Is coverage only for yachts or can I buy insurance for smaller boats?

My boat will be transported from a location to the Marina by road. Will damages be covered?

How wide is the trading area coverage?

See more FAQs

See more downloads

What our customers think

You might also like.

Privilege Motor A premium motor insurance plan for luxury vehicles with an impressive range of benefits and high limits. See more details See more details -->

Privilege Home Specially designed insurance plan for high-value homes, its contents, art pieces, jewellery and even liabilities. See more details See more details -->

You are being redirected to an external site. Please click Continue to accept or press Cancel to stay on current site.

To help personalize content, tailor and measure adverts and provide a safer experience, we use cookies. By clicking on Accept and close you are accepting the same.

Yacht Insurance

A yacht, at-least to most of us, is a luxury dream come true. Unless of course you are in the Forbes millionaires list! To make sure that you enjoy every minute on your hard earned yacht and the pleasure that it gives you when you go sailing or have a party with your friends, proper Yacht insurance is a must.To be able to sail around the Dubai Marina or any where in Dubai and the UAE for that matter, at your will and in your yacht, is a great achievement no doubt. We want to make sure that every thing stays perfect and you are sufficiently protected against unforeseen risks.

At Nabooda Insurance we can tailor a best fit yacht insurance policy once we understand your exact requirement and obtain the necessary information to work on. Some cover examples are provided below:

- Your yacht, your liabilities as an owner

- Personal accident cover for your invitees or guests and yourself

- Specified medical expenses as per terms and conditions of the policy

GET A QUICK QUOTE

Insurance quote.

Choose type of Insurance:

Health Insurance Life Insurance Car Insurance House Insurance Travel Insurance Business Insurance

Level of protection:

$0 - 250 $250 - 500 $500 - 750 $750 - 1000 $1000 - 1250

How Did You Hear About Us? Radio Ads - HIT FM Radio Ads - CITY FM Radio Ads - Al Arabiya Google Search ads Social media Emailer Print ads Outdoor Ads Friends and Family Our call center

Contact details:

I agree that my submitted data is being collected and stored.

- Help Line: 600 5 25502

- Email: [email protected]

- Whatsapp: +971 54 401 2676

Dedicated helpline numbers

Relax and enjoy your time on the water, yacht insurance | al buhaira insurance.

Accidents happen to even the most careful Yacht owners, and that is why proper insurance coverage is essential. ABNIC Yacht Insurance provides protection specifically designed for the needs of today’s Yacht owner. Our policy is flexible so we can customize to your particular needs. ABNIC has been delivering effective insurance solutions, efficient service, and marine expertise and our goal is to make the process of insuring your yacht as easy as possible.

We can help you insure your yacht with the right liability and damage coverage to protect you and your passengers. With ABNIC Yacht Insurance, your Yacht is insured on water and on land; boat, motor and trailer are all covered, and coverage for liability lawsuits and medical payments can be included. You’ll be able to relax and enjoy the water knowing you have the right coverage at a fair price

Our fully comprehensive yacht insurance comes with a wide range of benefits and outstanding service backed by a fast and fair claims settlement record all at a competitive price.

Yacht insurance is an important aspect of owning and operating a yacht in the UAE. Yacht insurance provides coverage for loss or damage to the yacht and its contents, as well as protection against liabilities that may arise from accidents or other incidents involving the yacht.

In the UAE, yacht insurance is regulated by the UAE Insurance Authority, and yacht owners are required to have insurance coverage in order to legally operate their vessel. There are several insurance companies in the UAE that offer yacht insurance, including local and international insurers.

Yacht insurance policies in the UAE typically provide coverage for the following:

- Physical damage to the yacht: This includes coverage for damage to the yacht's hull, machinery, and equipment caused by accidents, weather-related incidents, theft, or other covered events.

- Liability coverage: This includes coverage for damage or injuries caused to other boats, people, or property as a result of an accident or incident involving the insured yacht.

- Personal effects coverage: This includes coverage for loss or damage to personal items such as clothing, electronics, and other belongings on board the yacht.

- Medical coverage: This includes coverage for medical expenses incurred by the yacht owner, passengers, or crew as a result of an accident or illness while on board the yacht.

- Emergency assistance coverage: This includes coverage for emergency assistance services such as towing, salvage, and wreck removal in the event of an accident or other incident.

When choosing a yacht insurance policy in the UAE, it is important to consider the specific needs and requirements of the yacht owner. Factors such as the size and type of yacht, intended use, and cruising area should be taken into account when selecting a policy.

It is also important to review the terms and conditions of the policy carefully, including coverage limits, deductibles, and exclusions. Working with an experienced insurance broker or agent can help yacht owners find the best coverage at a competitive price.

In summary, yacht insurance is a crucial component of owning and operating a yacht in the UAE. With the right coverage in place, yacht owners can enjoy peace of mind knowing that they are protected against unexpected events and liabilities.

Reasons why one may choose Al Buhaira Insurance for yacht insurance in the UAE:

- Comprehensive coverage: Al Buhaira Insurance offers comprehensive coverage for yachts and other watercraft, including coverage for physical damage, liability, personal effects, medical coverage, and emergency assistance coverage.

- Experience: Al Buhaira Insurance has been providing insurance solutions in the UAE since 1978 and has a team of experienced professionals who can assist yacht owners in finding the right coverage for their needs.

- Competitive pricing: Al Buhaira Insurance offers competitive pricing for their yacht insurance policies, ensuring that yacht owners can obtain the necessary coverage at a reasonable cost.

- Customer service: Al Buhaira Insurance is committed to providing excellent customer service and has a dedicated team to assist clients with any questions or concerns they may have.

- Network of service providers: Al Buhaira Insurance has a wide network of service providers, including repair shops and contractors, to ensure that yacht owners have access to quality service when they need it most.

Overall, Al Buhaira Insurance offers reliable and comprehensive yacht insurance coverage at competitive prices, making them a top choice for yacht owners in the UAE.

Frequently Asked Questions:

Let us provide you with an insurance quote. We're here to help you better understand your risk exposures and how insurance can protect you.

Insurance : Insurance | Insurance Companies | Dubai Insurance | Insurance Market

Car Insurance : Car Insurance | Compare Car Insurance | Car Insurance Online | Cheap Car Insurance | Vehicle Insurance | Comprehensive Insurance | Third Party Insurance | Motor Insurance Dubai | Auto Insurance | Car Insurance Companies Abu Dhabi | Best Car Insurance | Car Insurance Renewal | Cheap Car Insurance Dubai | Car Insurance Transfer | How to Buy Car Insurance Online | Best Car Insurance in UAE | Motor Insurance UAE | Vehicle registration renewal | ADNOC Vehicle Inspection Centers

Bike Insurance : Bike Insurance | Motorcycle Insurance

Commercial Vehicle Insurance : Truck Insurance | Bus Insurance | Fleet Insurance | Motor Fleet | Company Fleet Insurance | Rental Car Insurance

Emirate : Car Insurance Dubai | Car Insurance Sharjah | Car Insurance Abu Dhabi | Car Insurance Al Ain | Car Insurance Ajman | Car Insurance Ras Al Khaimah | Car Insurance Fujairah | Car Insurance Umm Al Quwain | Car Insurance UAE | Car insurance Mussafah

Health Insurance : Health Insurance | Family Health Insurance | Group Health Insurance | Medical Insurance Dubai | Individual Health Insurance | Medical Reimbursement | Life Insurance | Domestic Helper medical Insurance | NAS Third Party Administrator (TPA)

Car Insurance Offer : Car Insurance Offer | FAZAA Card Holders | Esaad Card Holders | Homat Al Watan Card Holders

We provide insurance for all sizes of Yachts including Super Yacht/Mega Yacht for boat owners requirements. Our policy covers loss or damage to Hull and Machineries / equipment’s of your Yacht and protects your liabilities toward third parties. We cover your Yacht whilst in Marina or ashore or during navigation and whilst in transit on land / trailers. Additional covers include Uninsured Boater Coverage. Personal Accident also can be provided for Crew on optional basis.

INSURANCE FOR YOUR LUXURY YACHT

- Hull & Machinery

- Equipment on Board.

- Third Party Liabilities.

- Pollution Spill

- Uninsured Boater Coverage.

- Personal Accident for Crew.

Insuring Your Onshore Energy Activities

Please note that the above cover description is for information and does not represent the full coverage. For any clarification or information request, please contact National General Insurance Company Customer Service Desk.

Manage your Insurance Plan

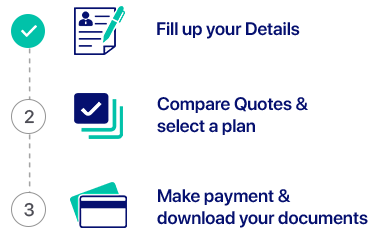

Buying Insurance is now just a click away

How to Get Insured

Wondering how to get insured? Click here to find out

Make a Claim

Submit and track your request and claims online

Owning a yacht can be an expensive hobby, especially when things go wrong. Protect your investment with a comprehensive insurance package from Alliance. We have more than forty years experience dealing with yacht insurance and only work with the world’s leading reinsurance partners, giving you the best coverage available.

Contact our support team on 04 605 1111 or email [email protected] for details.

- Life Insurance

- Group Life Insurance

- Health Insurance

- General Insurance

- Information

- Why Alliance

- Terms & Conditions

- Privacy Policy

- Alliance Insurance PSC, P O Box 5501, Dubai, U.A.E

- Telephone: +971 4 605 1111

- Email: [email protected]

- facebook Twitter --> Linkedin instagram

Copyright © 2024 ALLIANCE. ALL RIGHTS RESERVED.

- Car Insurance

- Compare Car Insurance

- Bike Insurance

- Fleet Insurance

- Boat Insurance

- Third Party Insurance

- Health Insurance for All

- Individual Health insurance

- SME Insurance

- Workmen Compensation

- Professional Indeminity

- Medical Malpractice

- Get business Insurance Quote

- Life Insurance

- Term Life Insurance

Marine Insurance in UAE

Compare and buy marine insurance now, 35+ insurance partners, 600+ corporate clients, 5000+ cars insured, 10000+ policies sold, get your marine insurance cover today.

- Not Covered

- Who Requires

- policy house

- Marine Insurance

What is Marine Insurance?

A contract of indemnity known as a marine insurance policy ensures that the goods being transported from their place of origin to their destination are completely insured. Marine insurance Dubai and the UAE covers any loss or damage to terminals, cargo, ships, and other modes of transportation needed to convey goods between their origin point and their arriving point. But despite what the name might suggest, these insurance plans cover all forms of cargo transportation. To illustrate, the policy referred to as marine cargo insurance is applicable when products are being transported by air.

What Does Marine Insurance Cover?

The loss or damage to the commodities sustained during shipping between the origin point and the destination point is covered by marine insurance Dubai and the UAE. This insurance policy also covers hull, marine liability, and exposed commodities that are stored offshore or onshore.

Marine cargo insurance covers fire accidents, sinking, collision, derailment of land conveyance, survey fees, cost of reconditioning, jettisons, general average sacrifice salvage charges, explosion, stranding, overturning, if cargo leaves port in distress, natural calamity damage, forwarding expenses, washing overboard, and total loss of package during loading or unloading.

Here are the details of the top inclusions in marine insurance Dubai and the UAE. The insured can select from the marine insurance coverage options in accordance with the Institute Cargo Clauses (ICC), which include ICC (C) coverage for sinking, jettisoning, fire, discharge of cargo at a port of distress, lightning, derailment or overturning of a land conveyance, stranding, general average sacrifice, grounding or capsizing of a vessel or an aircraft, and collision or contact of a conveyance, vessel, or ship with any external object except for water.

Risks linked with ICC (B) are washing overboard, holding or place of storage, volcanic eruption, lightning, earthquake, sea, river, or lake entering into a watercraft or vessel, and the risks related to ICC (C). ICC (A) - All hazards, excluding those specifically excluded. Except for the exclusions indicated, ICC (Air) covers "all risks" for air freight. The ICC (War & Strikes), includes war, strikes, and other events not covered by the core ICC clauses.

What Does Marine Insurance Not Cover?

The top exclusions of a marine insurance policy are malicious damage, bankruptcy, liquidation, insolvency, riots, wars, strikes, poor packaging, civil commotion, compliance with nations where locally admitted practices are recognized, and cargo to unsanctioned nations. Failure of finances and intentional damage or loss are also not covered under marine insurance Dubai and the UAE.

Who Requires Marine Insurance?

You can buy a marine insurance policy if you are: a seller, individual buyer, manufacturer, buying agent, import/export merchant, bank, contractor, an individual having a moving company, or freight forwarder. Import, export, inland marine insurance, marine cargo insurance, hull insurance, and freight insurance are the types of the marine insurance policy.

Benefits of Procuring Marine Insurance

There are many benefits to purchasing a marine insurance policy. First of all, it serves as a financial safety net in the event of unexpected catastrophes. Add-on covers offer improved insurance against conflict, terrorism, etc. at a higher cost. It enables companies to bounce back from setbacks without having to stop working. Pleasure craft, yachts, and personal watercraft (PWC) insurance are available to independent owners. Also, a few boat insurance plans include wreck removal and salvaging without any hull coverage additional fee.

This insurance is also available in a variety of forms. Hull insurance covers the conveyance's hull and torso. It safeguards the item against harm and accidents. Goods in transit from the country of origin to the country of destination are safeguarded by a marine cargo insurance policy. A yacht insurance policy will indemnify and cover the liabilities of a sailing vessel. Choose the one that suits you best with us and buy marine insurance online now!

Need More Info? Here’s Our Expert Guide To Help.

Is marine insurance mandatory in UAE?

Although it is not compulsory in the UAE, marine insurance is strongly advised for companies and people engaged in marine transport to protect themselves from unpredicted things.

How much does marine insurance cost?

Many variables, including the kind of coverage, the risk involved, the manner of transportation, and the value of the products, can affect the price of maritime insurance Dubai and the UAE. If you want to receive a precise cost estimate, then we suggest you request a quote from your insurer.

What should I consider before purchasing marine insurance?

You should mind the items you transport, the risk involved, the manner of delivery, and the cargo value before buying a maritime insurance policy. Kindly check the policy's terms and conditions and the insurer's reputation as well. Here, you can choose policyhouse.com without any doubt or worry. Our experience in the industry is our promise!

How do I make a claim under marine insurance?

You should notify your insurer right away if something is lost or damaged during transit, and offer them all the paperwork and proof you'll need to back up your claim. Your insurer will assist you as needed and walk you through the claims procedure. Policyhouse.com promises super-simple claims and quick and easy processing.

facebook Rating

(Based on 197 Reviews)

Our Insurance Partners

Type of insurances we offer

- Health Insurance

- Individual Health Insurance

- Home Insurance

- Business Insurance

- Workmen Compensation Insurance

- Professional Indemnity Insurance

- Medical Malpractice Insurance

- Motor Insurance

- Travel Insurance

Related Links

- Privacy Policy

- Terms & Conditions

Insurance is provided by

Block E 306 - 308, Al Shoala Building , Port Saeed, Near Deira City Center, Dubai,

Email: [email protected], phone: +971 46 016 905, www.policyhouse.com

- Retirement Planning

Yacht Insurance

- Erection All Risk Insurance

Get A Quote

Secure your yacht with our trusted insurance.

Yacht insurance is an insurance policy that provides indemnity liability coverage for a sailing vessel. It includes liability coverage for bodily injury or damage to the property of others and damage to personal property on the vessel. It has two principal parts: hull insurance and protection and indemnity (P&I) insurance.

While there is no legal agreed upon length that separates a yacht from a pleasure boat, generally it is considered to be somewhere between 27 and 30 feet.

Third Party Liabilities

Covers bodily injury and third party property damage caused by the yacht owner to others and this includes passenger legal liability

Uninsured Boater Coverage

helps pay for injuries to people on your boat sustain from another boater who does not have insurance

What We Cover

We provide insurance for all sizes of Yachts including Super Yacht/Mega Yacht for boat owner’s requirements.

Our policy covers loss or damage to Hull and Machineries / equipment’s of your Yacht and protects your liabilities toward third parties.

We cover your Yacht whilst in Marina or ashore or duringnavigation andwhilst in transit on land / trailers. Additional covers include Uninsured Boater Coverage. Personal Accident also can be provided for Crew on optional basis.

Talk to Our Expert

Our partners, trusted coverage through our exceptional network of insurance partners..

Frequently Asked Questions

Yacht Insurance is a specialized policy designed to offer liability coverage for sailing vessels. It safeguards against potential liabilities related to bodily injuries, property damage, and personal property damage on the yacht. It’s typically divided into hull insurance and protection and indemnity (P&I) insurance.

Yacht Insurance provides a myriad of benefits, including coverage for third-party liabilities, protection against uninsured boaters, and personal accident coverage for the crew. It ensures that damages to others caused by the yacht owner, injuries from uninsured boaters, and crew member accidents are financially covered.

Yes, our insurance policies cater to all yacht sizes, encompassing Super Yachts and Mega Yachts, and are tailored to meet the specific needs of boat owners.

The policy comprehensively covers loss or damage to the yacht’s hull, machinery, and equipment. It also shields your financial liabilities towards third parties. Coverage extends to your yacht whether it’s in the marina, ashore, navigating waters, or in transit on land/trailers.

Leading insurance brokers in the UAE operating via our regional offices in Dubai & Abu-Dhabi. We strive to provide the best cover that not only meets your needs but gives you the best value for your money.

- Child Education

Quick Links

- To Omega – Complaints

- To DHA - Complaints

- To Insurance – Authority

- Get A Free Quote

- Toll Free Number - 800 66342

News & Events

Follow us on.

- ENQUIRE FOR MORE:

GET INSURED; PROTECT WHAT MATTERS MOST

Get a quote.

Insurance Broker in UAE, Best Insurance Brokers Dubai, Insurance & Wealth Management Company in Dubai, Abu Dhabi, Sharjah, Ajman, Umm Al-Quwain, Fujairah & Ras Al Khaimah, UAE

Car Insurance

Health Insurance

General Insurance

Corporate Insurance

Life Insurance

Financial Planning

Investments

Yacht Insurance in UAE

- Perils of the seas, rivers, lakes or other navigable waters.

- Fire, Jettison and Piracy.

- Contact with Dock or Harbors, Land Conveyance.

- Malicious acts

- Theft of the entire Vessel or her boat(s) or Outboard Motor(s)

- Latent defects in Hull or Machinery

- Loss or damage to any other vessel or property

- Loss of Life, Personal injury or illness

- Removal or destruction of a wreck

- Outboard motor dropping off or falling overboard

- Person affected

- Liability to or incurred by any person engaged in water skiing or aqua planning

- War and strikes risks

- Machinery damage

- Inland transit risks

- Personal Accident cover

- Medical expenses cover

- Cruising limits

- Fire and safety equipment

- Age of the captain

- Construction

- Navigation (cruising limits)

- Purpose of usage [private or commercial]

- Passenger capacity

- Previous loss history etc

- Damage to the yacht or boat due to perils of the sea

- Death or injury to the occupants of the yacht or boat

- Medical treatment for crew and passengers for injuries

- Loss or damage to personal devices, cash, jewelry

- Third-party coverage plus add-on

- Under comprehensive coverage, your guest will also be compensated for damages and injuries even if there is a collision with another boat operated by an uninsured or unknown person in the sea.

- Sailing on a yacht is an adventure and a thrilling sport. Accidents can happen anytime and may result in bodily injuries. In the event of an accident, you will be eligible for financial compensation for search and rescue expenses.

- Yacht and boat insurance is renewed every year and if you haven't claimed a reimbursement in the previous years, you are eligible for a premium payable rebate.

- If you buy special coverage, you will be compensated for losses and damages sustained by intruders forcibly entering the boat and causing damage. Compensation also includes cash carried with you at the time of the event.

- Traveling inside the boat is risky. Accidents can happen due to slippage and falling, accidents due to fire and electrical short circuits, and kitchen-related happenings. They are called personal accidents and can be covered with additional premium payments.

- If you are a motorboat sportsperson, you know the risks that come with it. These risks can also be covered with additions to the standard boat insurance to give you more confidence. You can also include your spouse and children to make a financial claim for an accident.

Choosing the Right Plan and Saving Money

Don't be overwhelmed by the vast options in yacht and boat insurance. By comparing the various features and risk coverage, you should be able to decide on the best. Our experts are there to help and guide you in the selection process to give you the most benefits at a lesser price.

Claims Management Support

Simplified claims processing is the hallmark of all our Yacht and Boat Insurance policies. If you have to make a claim, our advisors will help you to prepare and submit the documents. This will assist you with getting reimbursement on time. Our insurance advisors are trained to make a proper claim. We will stay with you till all claims are processed and the claim amount has been transferred to you.

Coverage of Yacht & Boat Insurance

All people at stake in the yacht or boat can be covered. the following losses are frequent in yacht and boat operations either for commercial use or for pleasure., comprehensive coverage, top features, special yacht and boat coverage, compare and get instant quotes from our online insurance portal, how insurancepolicy.ae works (simple, speedy, secure).

Speak With One Of Our Experts Today

Phone number.

+971 4 357 7997 +971 4 346 6567

+971 054 7320 469

Why Platinum

Years of Experience in the Industry

Partnerships with Insurers & Financial Institutions

Clients all Over the Globe

Let’s get started

Appointment, lets protect your business, life and much more.

- 41-B Zomorrodah Building, Landmark- Huzaifa Furniture Umm Hurair Road, Dubai, U.A.E

- +971 4 357 7997, 346 6567

- +971 50 473 8811

- [email protected]

Looking for: Car Insurance Health Insurance General Insurance Life Insurance Financial Planning Investment Planning Group Medical Insurance Motor Fleet Insurance Liability Insurance Property Insurance Marine Cargo Insurance Engineering & Construction Insurance

- All Insurances At One Place

- Boat Insurance

Boat Insurance is also called Yacht Insurance or Pleasure Craft Insurance. It is a kind of cover that offers indemnity cover on pleasure crafts, mega yachts and commercial yachts for unintentional loss, injury or destruction. Yacht Insurance not only protects your vessel, it additionally covers other vessels, your passengers and other people you may get into contact are extensively safeguarded.

Boat Insurance In Dubai

To be able to sail across the Dubai Marina or any where in Dubai and the UAE for that matter. At will and in your yacht, is a great getaway from busy lifestyle, no doubt. Keeping in mind that every thing remains perfect and you are sufficiently safeguarded against unforeseen risks.

But, Imagine facing an emergency situation in the center of the ocean. That puts the safety of your vessel and people on board at risk? Your ideal holiday can get ruined in a mere split of seconds despite getting the tiniest of mishaps. But if you have Yacht Insurance In Dubai with proper coverage, you can take a deep breath relax and enjoy the trip.

At Dubai Online Insurance we can offer top yacht insurance policy once we understand your requirements and gather the necessary information.

Types Of Boat Insurance Dubai

There are mainly five types of covers for boat insurance which are discussed as under :

- All Risk Comprehensive Insurance

- Third Party Insurance

- Loss Or Damage To Hull And Machinery

- Agreed Value Insurance

- Market Value Insurance

All Risk Comprehensive Insurance

Comprehensive Yacht Insurance provides cover for loss due to all perils and incidents except the ones that are specifically excluded in the policy. This sort of insurance supplies the widest coverage range.

Third Party Insurance

This policy protects the insured from bodily injury or physical damage. Caused to a third party by paying for any legal liability as well as paying out for losses.

Loss Or Damage To Hull And Machinery

This type of insurance safeguards the body and machinery of your boat. Against total loss or physical damage due to challenges of the navigable waters and other human risk factors associated with functioning of the vessel.

Agreed Value Insurance

This involves the boat owner and the insurer agreeing on a particular value for the yacht. In case of a case made against the vessel being announced a total damage, the arranged value is reimbursed.

Market Value Insurance

This insurance pays out the money value of your yacht in the event of entire loss. The settlement is usually less than the established value because the insurance provider considers depreciation as well as the entire condition of your yacht through the incident.

Additional Covers For Boat Insurance

There are nine optional covers that help the asset owner in getting overall protection for his/her boat insurance / yacht insurance. The covers are explained as follows :

Extended Geographical Area Coverage

Yacht Plans restrict the geographical place within which your plan is valid. This optional cover broadens the navigational limitations of your yacht.

Personal Accident Cover

This cover protects the insured individuals against accidental physical injury, death or disablement while onboard.

Towing For Watersports Cover

Pull tubes, wake boarders and normal water skiers require additional protection plans. This program provides cover for your legal responsibility to compensate fatality or physical problems for a person being towed because of your boat.

Commercial Usage Cover

That is a specialized cover for businesses that manage commercial and charter yachts, or book boats.

Emergency Service Cover

This cover consists of search and rescue as well as towing and assistance in case there is an emergency.

Personal Effects/Belonging Cover

This extension covers all components of personal effect carried on-board. That are lost or damaged due to perils of the ocean, fire, theft, collision or malicious acts. This expansion covers all components of personal belongings taken on-board, lost or harmed anticipated to perils of the ocean, flame, theft, collision or malicious operates.

Protection and Indemnity Cover

That is a collision and liability cover that protects the yacht owner against legal liability. Which might arise due to collision and harm to alternative party when the payout from third party liability cover is insufficient.

Land Transit Cover

This insurance category covers the vessel whilst in transit between your marina and the owner’s residence and vice versa, through land..

Uninsured Boater Cover

This compensates for personal injuries on-board the insured boat triggered by an another boat that has no liability insurance.

Who Needs Boat / Yacht Insurance ?

Associated with the Maritime Code of the UAE authorities. All recreational, commercial, sporting activities, tourism and traditional marine crafts have to be covered by insurance. In the name of the vessel owner, manager or bare boat charterer. This underwriting was endorsed to ensure the highest degrees of maritime safeness and secure navigation uniformly. Inability to obtain insurance coverage for your yacht may lead to hefty fines.

Is Boat / Yacht Covered If Its Outside Of UAE ?

The boat / yacht Protection plans is normally valid only within the coastal waters of the UAE. For better coverage, you can select the optional extended geographical area cover to go with your existing plan.

We as an Insurance(Tameen) specialist, specialize in the following areas :

- Property All Risk Ins. / Fire Ins .

- Marine (SEA/AIR/ROAD) .

- Motor Ins / Vehicle Ins / Car Insurance

- Workmen’s Compensation Ins .

- Building Insurance and Landlord Insurance

- Contractor’s All Risk Ins .

- Professional Indemnity Ins .

- Health Insurance Dubai

- Third Party Liability Ins .

- House Holder’s Ins .

- Jeweler’s Block .

- Contact Us To Know More….

We provide other covers beside these, also if you have any queries feel free to contact us, and we will designate an insurance specialist to you who will guide and answer your questions. Our fast, efficient, courteous team will be at your service.

Email : [email protected]

Tel : 050 717 9800

CAPITAL CORP. SYDNEY

73 Ocean Street, New South Wales 2000, SYDNEY

Contact Person: Callum S Ansell E: [email protected] P: (02) 8252 5319

WILD KEY CAPITAL

22 Guild Street, NW8 2UP, LONDON

Contact Person: Matilda O Dunn E: [email protected] P: 070 8652 7276

LECHMERE CAPITAL

Genslerstraße 9, Berlin Schöneberg 10829, BERLIN

Contact Person: Thorsten S Kohl E: [email protected] P: 030 62 91 92

- Motor Insurance

- Bike Insurance

- General Insurance

- Engineering Insurance

Marine Insurance

- Health Insurance

- Aviation Insurance

- Home Insurance

- Life Insurance

- Life Insurance/savings

- Travel Insurance

- Fire Insurance

- Miscellaneous Insurance

- Feedback & Complains

- Terms and Conditions

A simple definition of the word insurance would be “Protection against future loss.” Marine insurance is another variant of the general term ‘insurance’ and as the name suggests is provided to ships, boats and most importantly, the cargo that is carried in them. Marine insurance is one of the most important types of insurance because through it, ship owners and transporters can be sure of claiming damages especially considering the mode of transportation used. Water transport is the latter most among the four modes of transport – road, rail, air and water – which causes a lot of worry to the transporters not only because there are natural occurrences which have the potential to harm the cargo and the vessel but also other incidents and attributes which could cause a huge loss in the financial casket of the transporter and the shipping corporation.

Types of marine insurance, hull insurance.

Hull insurance mainly caters to the torso and hull of the vessel along with all the articles and pieces of furniture on the ship. This type of marine insurance is mostly taken out by the owner of the ship to avoid any loss to the vessel in case of any mishaps occurring.

Marine Cargo Insurance

Cargo insurance caters specifically to the marine cargo carried by ship and also pertains to the belongings of a ship’s voyages. It protects the cargo owner against damage or loss of cargo due to ship accident or due to delay in the voyage or unloading. Marine cargo insurance has third-party liability covering the damage to the port, ship or other transport forms (rail or truck) resulted from the dangerous cargo carried by them.

Yacht/Boat Insurance

Yacht insurance is an insurance policy that provides indemnity liability coverage on pleasure boats. Yacht insurance includes liability for bodily injury or damage to the property of others and damage to personal property on the boat. Depending on the insurance provider, this insurance could also include gas delivery, towing and assistance if your boat gets stranded.

© 2019 A.I.A.D.I.S. All Rights Reserved

JavaScript has been disabled on this browser. For a seamless experience, please enable the option to run JavaScript on this device

- Complaints & Feedback

Marine Insurance from AIG UAE

We can provide flexible marine insurance solutions in the uae that are customised to suit importers, exporters, vessel owners/ operators and inland marine, recreational marine and marine operations worldwide., marine cargo, inland marine, marine liability, recreational marine.

- 600 5 80000

- Investor Relations

- Request a Quote

- Within this Site

- Google Search

- Motor Fleet Motor Fleet

- Group Medical Group Medical

- Group Life & Personal Accident Group Life & Personal Accident

- Engineering Engineering

- General Accident General Accident

- Liability Liability

- Marine Marine

- Property Property

Marine Cargo Insurance

Get a Motor Policy

Get a Home Policy

Get a Travel Policy

Marine Cargo

DNI Marine Insurance in Dubai and Abu Dhabi covers goods whilst in transit by Sea or Air, depending upon the needs of the client

Single/Individual Land Transit Insurance

Under this insurance, coverage is given to a single shipment from a specified point of origin to the specified destination.

Open Cover/Annual Land Transit Insurance

An Open Cover/Annual Insurance is a contract covering all shipments of the Insured during the period of insurance on terms as agreed on a declaration basis. By availing this, the insured is relieved of the hassle of arranging separate policies for individual shipments and need only to make periodical declaration of the details of shipments.

Coverage can vary as under, based on the mode of transport or type of goods carried:

- All risks by sea or air or parcel post.

- Restricted cover by sea, air or parcel post.

The Amount covered is the agreed value, which in most cases will be CIF and/or C&F plus 10% or FOB plus 10% to 20%.

The factors taken into account for calculating the premium depend on the nature and type of cargo, method of packing, mode of shipment, age and type of vessel and the ports to be used.

Secure your cargo in-transit with DNI Marine Insurance policy and mitigate risks at affordable costs.

Scope of Cover

The insured has the option to choose the Marine Insurance coverage as per the following Institute Cargo Clauses (ICC) :

ICC (C) - Fire, lightning, stranding, grounding, sinking or capsizing of vessel or craft, overturning or derailment of land conveyance, collision or contact of vessel, craft or conveyance with any external object other than water, discharge of cargo at a port of distress, general average sacrifice and jettisoning.

ICC (B) - Earthquake, volcanic eruption or lightning, washing overboard, entry of sea, lake or river water into vessel, craft, hold, Conveyance, container, lift van or place of storage, in addition to the perils of ICC (C).

ICC (A) - All risks, subject only to the specified exclusions

ICC (Air) - Pertains to air cargo covering “All risks”, subject only to the specified exclusions

ICC (War & Strikes) - Covering war, strike etc. which are excluded in the basic ICC clauses.

Inland Transit

The following insurance under this category are intended to cover goods whilst in transit by Road or Rail, depending upon the needs of the client:

Under this insurance, coverage is given to a single transit from a specified point of origin to the specified destination.

An Open Cover/Annual Insurance is a contract covering all transits of the Insured during the period of insurance on terms as agreed on a declaration basis. By availing this, the participant is relieved of the hassle of arranging separate policies for individual transits and need only to make periodical declaration of the details of transits

The insured has the option choose the coverage as per the following :

- Land Transit All Risks Insurance: Covering All Risks, subject only to the specified exclusions

- Land Transit Basic Insurance: Covering 1) Fire 2) Lightning 3) Breakage of Bridges 4) Overturn of Carrying Vehicle 5) Collision with or by the carrying vehicle

Marine Hull

Ship-owners / Ship Managers are exposed to various maritime perils and we provide the following covers related to it:

Hull & Machinery [Covering the hull and machineries of the vessel against named perils and certain liabilities].

Protection & indemnity (covering wider marine liabilities)., marine cargo insurance faq.

You can conduct a risk analysis by which you consider all possible risks and determine which are the most significant for your particular business. After considering how likely various losses are to occur, how expensive they are to mitigate you can plan for your insurance cover.

The size of the company, type of industry, type of organizational structure, capitalization, geographical area, management team, degree of experience and expertise in the targeted business, capitalization, competitive environment and many other factors can have a bearing on the risk environment for the company. The business owners should address such issues in their business and strategic analyses of the company’s situation. A few of the potential operational risks are as follows:-

The cost is dependent on the specifics of your business situation.

Property insurance protects your buildings and equipment, stock, furniture and fixtures and business income coverage. Basic property insurance will generally cover your business for losses in the event of a fire or lightning strike and will pay the cost of removing property to protect it from further loss. Additionally, a standard small business insurance policy will usually cover losses from windstorm, hail, explosion, riot and civil commotion and damage caused by aircraft, automobiles or vandalism

Property insurance can be purchased on the basis of the property's replacement value (the cost of replacing the item without deducting for depreciation.

There are many different types of third-party liabilities to be covered for a business. Public liability insurance may protect you from claims arising from someone's bodily or personal injuries. Other items that could be covered are damage to the property of others, fire, legal liability and related legal defense costs.

This refers to the injury, sickness, disease, or even death, of any person that occurs during the policy period.

Workers' compensation pays for the rehabilitation, recovery and medical bills of employee’s work-related injuries, as well as lost time when they are unable to work because of a work-related injury. Workers' compensation is not a substitute for health or medical insurance, since employees are only covered for on-the-job injuries.

Workers' compensation is required when you have one or more employees.

Workers' compensation pricing is based upon your employee payroll, the number and job classification of the employees, classification of your business and past loss experience.

Errors & omissions insurance provides coverage for people who give advice, make educated recommendations, design solutions or represent the needs of others. "E&O" is also referred to as professional liability or malpractice insurance. This type of liability insurance would cover you and your employees in the event someone claims you incorrectly performed or failed to perform your professional duties.

04 595 9666

- Privacy Policy

- Terms & Conditions

- Refund & Cancellation details

- Construction & Infastrucutre

- Financial Institutions

- Hospitality

- Manufacturing

- Real Estate

- Can't find what you are looking for?

- Bankers Blanket Bond

- Commercial Property & Business Interruption

- Construction All Risk

Credit & Capital

- Directors' and Officers'

- Fidelity & Money

- Jewellers' Block

- Kidnap & Ransom

- Medical Malpractice

- Motor Fleet

- Professional Indemnity

- Reinsurance

- Terrorism & Political Violence

- Warranty Indemnity

Employee Benefits

- Employee Benefits Consulting

- Group Medical

- Group Personal Accident

- Group Travel

- Workers Compensation

Private Client

- Private Client overview

- Home & Contents Insurance

- Motor Insurance

- Private Medical (individual & family)

- Travel Insurance (individual & family)

- Trade Credit

- Clinical Trials Liability

- Cyber Liability

- General Liability

- Product Liability

- Asia Pacific

- The Americas

- Middle East & Africa

Don't see a country you're looking for?

Together with our partner brokers, we are part of a global network so whether you’re a multinational looking for a broker that’s truly global, or a smaller business looking to insure your local needs, we can help you.

Marine Insurance

We enable our clients to proactively manage risk in a way that increases their efficiency and their corporate competitiveness. the work we do does not start and end at renewal..

Clients stay with us because they meaningfully and directly benefit from more robust risk controls that lead to a reduction in operational cost and non-insurable expense over the full policy period.

We focus on solutions, keep it simple, challenge the status quo and deliver the right results. We manage complex marine casualties and claims in partnership with you, and provide critical advice and insight throughout the claims process.

What we do is split into three pillars.

Managing risk

We have real-time conversations with our clients on evolving risk issues. We offer contractual and preventative risk mitigation advice, and we offer concise thought leadership through client advisors and market updates.

Read our recent thought leadership here .

Managing marine casualties

We offer experience and a proven ability to offer practical solutions to complex problems.

We aim to reduce the cost of claims from the outset by providing experienced advice. We challenge claims adjusters’ views to obtain optimal amounts paid, and we challenge insurers to settle claims quickly. Thereafter we encourage insurers to pursue recoveries where possible, with the aim of improving our clients’ loss records.

We help our clients increase their corporate preparedness for dealing with major incidents, and we benchmark their ability to respond.

We produce customised claims manuals for our clients. We subsequently offer to embed incident preparedness through seminars and offer to test preparedness by running drills.

Getting the job done

We aid our clients to foster long-term underwriter engagement through roadshows. Competitiveness and proactivity, with a specialized team in your time zone, both come as standard.

We help our clients transfer risk through one or more of the 50+ marine insurance products we are able to place. Our marine specialists create bespoke insurance solutions for:

- Shipowners and ship operators;

- Bareboat charterers, time charterers and voyage charterers;

- Technical managers, commercial managers and crew managers;

- Port & terminal operators, port authorities and stevedores;

- Yacht builders, yacht owners, yacht managers and yacht rental companies;

- Ship builders and Ship repairers;

- Importers, exporters, traders and retailers;

- Transport operators, Freight forwarders and NVOCCs;

- Ship agents and shipbrokers; and

- Service providers to the oil & gas Industry

We take the complexity out of arranging the right solution around your exposures and risk appetite.

Our marine insurance solutions can be categorized into four segments.

Marine insurances for loss of or damage to the vessel

- Hull & Machinery, Increased Value and War Risks

- Trade Disruption, Loss of Hire, as well as corresponding total loss insurances

- Builders’ Risk

- Ship Repairers’ Liability

- Final voyages

- Subsea equipment

Marine insurances for vessel-related third party liabilities

- Protection & Indemnity and cover for legal expenses (FDD), as well as associated SOL cover extensions

- Charterers’ liability and associated insurances

- Contractual Liability

- Specialist Operations

- Liability to accommodees

- Towage Liability

- Marine PA/EL

- Divers’ Liability

- Contract Works

Marine insurances for non-vessel-related third party liabilities and other marine risks

- Kidnap & Ransom / Special Contingency insurance

- Ports & Terminals Liability, including Property and Business Interruption

- Handling Equipment

- General Liability / Comprehensive General Liability

- Umbrella Liability

- Public Liability

- On-shore Cyber and Crime

- Residual Value

- Financial Risk

Marine insurance solutions for loss of or damage to cargo and associated risks

- Stock Throughput

- Transport Operators

- War on Land

- Cargo Political Violence

- Storage / Excess Storage

- Project Cargo / DSU

Speak to a marine specialist today

Let's talk...

+971 4357 3835

We'll put you in touch with the person best equipped to help.

Call us on +971 4 357 3835 or drop us a message below and we'll get back to you as soon as possible

Find out more information about grievance procedures here .

Our office locations:

Dubai Latifa Towers East Wing – Level 1 Trade Centre 1, Sheikh Zayed Road Dubai, U.A.E. P.O. Box 49195 Location

Howden Specialty Gate Village 5, Level 4, Office 401 DIFC - Dubai, UAE P.O. Box 482078 +971 4 223 9964

Sharjah Office 1701, Level 17 City Gate Tower, Al Ettihad Street Sharjah, UAE Location

Howden Guardian New EMI State Tower Office - 103 & 104 Airport Road, Abu Dhabi - U.A.E. P.O. Box 51012 +971 2 491 3777 [email protected] Location

Abu Dhabi Office - 1010, Level 10 Al Obaid Office Tower, Airport Road Rashid Al Maktoum Street 2 Abu Dhabi, UAE P.O. Box 44897

PRESSR: ANIB introduces specialized marine insurance coverage for risks posed by geopolitical events

Dubai, UAE: In recent years, the global maritime industry has faced increasing threats from various geopolitical factors, including unstable conditions in which during war, attacks on cargo carrying vessels pose significant risks to shippers and businesses involved in international trade. ANIB's specialized insurance coverage for war and political risks is specifically designed to address these challenges, providing clients with peace of mind and financial protection in the face of uncertainty.

Key features of ANIB's Marine insurance include:

1.Tailored Solutions: ANIB works closely with clients to tailor insurance solutions to meet their specific needs and requirements. Whether operating in high-risk regions or facing unique geopolitical challenges, ANIB can customize coverage to suit each client's individual circumstances, providing targeted protection where it's needed most.

2. Expert Risk Assessment: ANIB's team of experienced insurance professionals conducts thorough risk assessments to identify and evaluate potential threats posed by geopolitical events. If you are considering insurance coverage for cargo-carrying vessels in areas affected by unstable conditions, you should consult with an insurance professional. By leveraging their expertise and industry insights, ANIB helps clients understand and mitigate risks effectively, ensuring they have the right coverage in place to protect their interests.

3.Transparent Disclosures: ANIB believes in full transparency when it comes to insurance

Clients receive clear and concise disclosures outlining the terms, conditions, and limitations of their policy, ensuring they have a complete understanding of their coverage. Our experts played a crucial role in facilitating war cover for clients amidst in the early 2000s during war. Their proactive approach involved not only arranging coverage but also meticulously identifying gaps within existing policies. Through exhaustive analysis of marine risks, they navigated complex scenarios, ensuring that clients were adequately protected.

Furthermore, their adept handling of claims resolution exemplified their commitment to client satisfaction, as they worked tirelessly to address issues and mitigate losses. Their expertise not only provided reassurance during turbulent times but also underscored their dedication to safeguarding client interests in the face of challenging circumstances. With ANIB's specialized Marine insurance coverage for war and political risks, businesses can mitigate the impact of geopolitical events on their operations and protect their assets against unforeseen losses. By offering comprehensive coverage, tailored solutions, and expert risk assessment, ANIB is the trusted partner for businesses seeking to safeguard their interests

in an uncertain world.

For more information about these strategic collaborations and ANIB insurance solutions, please contact 800 ANIB 04 3121 332 or WhatsApp +971 54 401 2676 or visit www.anib.ae

About ANIB:

Starting our journey in 2007, Al Nabooda Insurance Brokers (ANIB) has been committed to delivering personalized and comprehensive insurance solutions in Dubai, UAE. Whether you're an individual seeking optimal car insurance or a corporate leader in search of a group medical insurance package, our expertise is at your service. Our aim is to steer you through the decision-making process, furnishing you with accurate information to empower your informed choice. As adept Insurance Brokers, we prioritize crafting a seamless, pleasant, and rejuvenating insurance encounter. Our core values revolve around transparent and truthful transactions, advocating for our clients to the utmost of our capabilities. Renowned as a dependable and highly endorsed insurance broker in Dubai, we establish exacting standards, ensuring unwavering support during insurance claims. Rest assured; we stand by your side every step of the way.

© Press Release 2024

Disclaimer: The contents of this press release was provided from an external third party provider. This website is not responsible for, and does not control, such external content. This content is provided on an “as is” and “as available” basis and has not been edited in any way. Neither this website nor our affiliates guarantee the accuracy of or endorse the views or opinions expressed in this press release.

The press release is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Neither this website nor our affiliates shall be liable for any errors or inaccuracies in the content, or for any actions taken by you in reliance thereon. You expressly agree that your use of the information within this article is at your sole risk.

To the fullest extent permitted by applicable law, this website, its parent company, its subsidiaries, its affiliates and the respective shareholders, directors, officers, employees, agents, advertisers, content providers and licensors will not be liable (jointly or severally) to you for any direct, indirect, consequential, special, incidental, punitive or exemplary damages, including without limitation, lost profits, lost savings and lost revenues, whether in negligence, tort, contract or any other theory of liability, even if the parties have been advised of the possibility or could have foreseen any such damages.

More From Forbes

Sunreef yachts opens massive production facility in the united arab emirates.

- Share to Facebook

- Share to Twitter

- Share to Linkedin

From left: Sunreef Founder Francis Lapp, His Highness Sheikh Saud bin Saqr al Qasimi, and Lech ... [+] Walesa at the opening of the new Sunreef production facility in Ras Al Khaimah, UAE.

I’ve had a soft spot in my heart for Sunreef Yachts since I first visited the shipyard in Gdansk, Poland where a hard-working entrepreneur named Francis Lapp was building large luxury catamarans. That was way back in 2010. And since his fledgling shipyard was located in the Gdansk Shipyard where Lech Walesa helped found the Solidarity trade union that played a key role in the eventual collapse of the Soviet Union, it was inspiring to see something so new and innovative emerging from such a historic place. Little did I know that he was just getting started!

Sunreef Yachts newest production facility opens in the UAE

Since then, Sunreef Yachts have continued to push the innovation envelope when it comes to the design and construction of fully-customized eco-responsible catamarans and multihull superyachts. Sunreef Yachts’ current range of sailing and power catamarans ranging from 50-feet to 210-feet-long! And Lapp’s company combines electric propulsion, smart energy management, ultramodern solar panels and ethically-sourced finishing materials to provide a yachting experience unlike many other yachts.

Rafael Nadal's Sunreef 80 catamaran Great White is capable of fast passage speeds.

I also love how astute Lapp is when it comes to recruiting high-profile owner/ambassadors who include superstars like Rafael Nadal and Formula 1 champions Fernando Alonso and Nico Rosberg. Sunreef Yachts are cool and in high demand for lots of reasons.

Best High-Yield Savings Accounts Of 2024

Best 5% interest savings accounts of 2024.

Rafael Nadal onboard his Sunreef 80 Great White.

In fact, demand has been so high, the always forward-looking Lapp wasted no time in developing a brand-new, state-of-the-art new production facility that just opened in Ras Al Khaimah in the UAE.

I saw it for myself last week during a break from the Dubai Boat Show last week. And I have no doubt the new facility’s modern paint shop, laminating, carpentry, upholstery and stainless-steel work will be world class.

According to Lapp, Ras Al Khaimah in the UAE was the best strategic choice for this new facility due to Ras Al Khaimah’s incentive, industry support, and easy access to key markets and transportation infrastructure.

His Highness Sheikh Saud bin Saqr al Qasimi touring th recently opened Sunreef production facility ... [+] in Ras Al Khaimah. UAE

“We can now further expand in an environment that merges perfect strategic location, skilled workforce and proactive mindset,” says Lapp. “The yachts produced in Ras Al Khaimah will elevate eco-responsible yachting to a new level and showcase industry-first technology. I would like to thank the RAK Government and RMC management for their invaluable support in making this dream possible and I look forward to building a better future for yachting here.”

“The Ras Al Khaimah shipyard that we are now developing works hand in hand with our local Dubai office, employing a team of specialists from various fields,” adds Sunreef Yachts Middle East Director Munira Lapp. “The aim is to form a yachting think tank that will not only anticipate trends, but also shape the future of yachting with creative solutions. I believe the RAK facility will be the perfect infrastructure to carry out the most advanced eco responsible yachting concepts.”

Work has begun at the new Sunreef Yachts production facility in the UAE

It’s obvious the new facility is an important part of Sunreef Yachts’ global expansion strategy that will not only strengthen the company’s presence in the Middle East, but also allow a stronger connection with the Asian and Australian markets. And with the company’s two existing manufacturing sites in Poland, Sunreef Yachts is most definitely going global.

Watch this space.

- Editorial Standards

- Reprints & Permissions

IMAGES

COMMENTS

Yacht Insurance. AXA Sail Master Plus is a flexible product, locally developed and improved through the years to cater for boat owners' requirements. Our comprehensive cover option responds to accidental loss or damage to your boat and protects your liabilities toward third parties. Your boat will be covered whilst in use or moored afloat or ...

WE WORK WITH THE LEADING YACHT INSURERS IN THE UAE. At InsuranceMarket.ae we're proud to have enjoyed over 25 years' experience of helping customers with their insurance needs and over these years have built great partnerships with the leading and most respected Yacht Insurers in the Dubai/UAE market: big names such as AXA, Oman, Orient, Al Sagr and many more.

Insurance for loss or damage to yachts. This includes outboard motors, trailers, and any gear or equipment covered by named perils according to Institute Yacht Clauses. Covering loss of or damage to your yacht/boat: Caused by fire, lightning, collision, stranding, sinking, stressful weather conditions, and contact with external objects.

Comprehensive Medical Insurance. From boats to megayachts, the vessels need comprehensive insurance to sail away smoothly. It's covered even if it's moored ashore, which makes the Yacht Insurance even more important. Contact us at 971-6 568-4242!

Buy Marine Hull (Pleasure Craft) Insurance from Sukoon Insurance, Dubai for motorboats, jet skis, yachts and sailing boats. Cover for personal and third-party damage. Rebrand ... Our Yacht Insurance product is developed keeping your convenience at its core. With more than 45 years of expertise, our comprehensive cover for yachts, pleasure craft ...

At Nabooda Insurance we can tailor a best fit yacht insurance policy once we understand your exact requirement and obtain the necessary information to work on. Some cover examples are provided below: To know more and tailor a best fit yacht insurance policy, call us now on 600-5-25502 or send in your query [email protected].

Comprehensive coverage: Al Buhaira Insurance offers comprehensive coverage for yachts and other watercraft, including coverage for physical damage, liability, personal effects, medical coverage, and emergency assistance coverage. Experience: Al Buhaira Insurance has been providing insurance solutions in the UAE since 1978 and has a team of ...

Awnic offer specifically designed protection plan for Yacht owner.Awnic policies are flexible so we can customize to your particular needs with best insurance plans 600 54 40 40 Login

Yacht Insurance Dubai, get the best insurance deals to cover your yacht. Our commercial boat insurance companies are reliable to secure your boat & protect you from financial losses. +971 4 211 5800

Yet, if you have Yacht Insurance in Dubai with appropriate inclusion, you can take a full breath unwind, and appreciate the excursion. Types of Boat Insurance in Dubai. Majorly, there are five types of covers under boat insurance: 1 All Risk Comprehensive Insurance. Comprehensive Yacht Insurance gives spread to disaster because all things ...

Protect your investment with a comprehensive insurance package from Alliance. We have more than forty years experience dealing with yacht insurance and only work with the world's leading reinsurance partners, giving you the best coverage available. Contact our support team on 04 605 1111 or email [email protected] for details.

Yacht and Boat insurance covers Hull & Machinery, Collision & Legal Liabilities. Coverage extends to all equipment that is mounted on the boat or used to operate it safely. ... Arab Insurance Company is the world's largest and oldest Sharia'h compliant Takaful solutions provider listed in Dubai Financial Market with paid up capital of 939 ...

Marine insurance Dubai and the UAE covers any loss or damage to terminals, cargo, ships, and other modes of transportation needed to convey goods between their origin point and their arriving point. But despite what the name might suggest, these insurance plans cover all forms of cargo transportation. To illustrate, the policy referred to as ...

Yacht insurance is an insurance policy that provides indemnity liability coverage for a sailing vessel. It includes liability coverage for bodily injury or ... We are the best insurance brokers in Dubai, Abu Dhabi, UAE. Providing insurance solutions since 2003, we offer cost-effective life insurance, personal insurance, and general insurance.

ADNIC offers reliable, affordable insurance for yachts, boats, jetski in Dubai, Sharjah, Abu Dhabi & UAE. Our personal watercraft insurance covers all types of boats that are tailored to your needs. Learn more here.

Planning to buy yacht insurance in Dubai, UAE? Platinum Insurance Broker LLC provides the best yacht, hull, and machinery insurances in Dubai, UAE at the lowest prices. Coverage of Yacht & Boat Insurance All people at stake in the yacht or boat can be covered. The following losses are frequent in yacht and boat operations either for commercial ...

Boat Insurance In Dubai To be able to sail across the Dubai Marina or any where in Dubai and the UAE for that matter. At will and in your yacht, is a great getaway from busy lifestyle, no doubt. Keeping in mind that every thing remains perfect and you are sufficiently safeguarded against unforeseen risks.

Yacht insurance includes liability for bodily injury or damage to the property of others and damage to personal property on the boat. Depending on the insurance provider, this insurance could also include gas delivery, towing and assistance if your boat gets stranded. Navigate the high seas with confidence with our Dubai-based marine insurance ...

We can provide flexible marine insurance solutions in the UAE that are customised to suit importers, exporters, vessel owners/ operators and inland marine, recreational marine and marine operations worldwide. Marine Cargo. ... American Home Assurance Company (Dubai Branch) is registered under UAE Federal Law No. 6 of 2007 with Insurance ...

We provides insurance for you that is as bespoke as your yacht. We protect you from stormy seas and unforeseen events. ... Yacht builder's risk insurance; Professional liability insurance; And for all your other precious assets . ... Dubai, UAE +971 (0)42 67 75 88. Fort Lauderdale +1 954 524 4250 . Geneva +41 228 10 8200 .

Yacht Insurance. GIG Sail Master Plus is a flexible product, locally developed and improved through the years to cater for boat owners' requirements. Our comprehensive cover option responds to accidental loss or damage to your boat and protects your liabilities toward third parties. Your boat will be covered whilst in use or moored afloat or ...

Hull & Machinery [Covering the hull and machineries of the vessel against named perils and certain liabilities]. Protection & Indemnity (Covering wider marine liabilities). Dubai National Insurance provide flexible marine insurance in Dubai that are customized to suit importers, exporters, vessel owners or operators and marine operations.

We help our clients transfer risk through one or more of the 50+ marine insurance products we are able to place. Our marine specialists create bespoke insurance solutions for: Shipowners and ship operators; ... Office 401 DIFC - Dubai, UAE P.O. Box 482078 +971 4 223 9964. Sharjah Office 1701, Level 17 City Gate Tower, Al Ettihad Street Sharjah ...

Starting our journey in 2007, Al Nabooda Insurance Brokers (ANIB) has been committed to delivering personalized and comprehensive insurance solutions in Dubai, UAE. Whether you're an individual seeking optimal car insurance or a corporate leader in search of a group medical insurance package, our expertise is at your service.

30th Dubai International Boat Show Embraces Superyachts And Hypercars Feb 26, 2024, 09:13am EST Bilgin Yachts' First Launch Of 2024 'Eternal Spark' To Debut At Monaco