Featured Yachts

Worldwide Search

Trying to Reason with Hurricane Season: Yacht Insurance and Prepping for Storms

Blame it on the weatherman: it can be a yacht owner's worst nightmare when a storm on the sea picks up speed and a name and heads straight for your boat's harbor. Yacht ownership comes with a lot of joy, freedom, and adventure, but also a hefty amount of responsibility, especially when hurricane season comes into play. As another season approaches, we sat down with yacht insurance broker Hugo Hanham-Gross of Hanham Insurance Agency to talk about the ins and outs of getting insured, including the hurricane preparedness plans that insurance carriers want to see.

Why Yacht Insurance Is Important

Insuring your yacht is a no-brainer: you want to protect your investment. Insurance may not be required as far as particular state laws go, but many marinas don't allow uninsured boats to dock, and for good reason: the sky is the limit for how much damage a boat can do to someone else's property. Most insurance policies are comprehensive and will include hull coverage for the boat itself, coverage for the personal property on board, coverage for your tender, liability coverage, and uninsured boater coverage. Uninsured boaters who cause property damage can be held liable for tens of thousands of dollars (or more), which they must pay out of their own pocket if they're in an accident. No one wants to be stuck with a bill like that. Yacht insurance is a necessary part of yacht ownership responsibility, to protect yourself and anyone or anything around your boat.

.png?width=898&height=449&name=unnamed%20(4).png)

What affects rates?

Your rate depends on a variety of factors, including the value of the boat, your hurricane plan, and how many years of experience you have with boats. Now let's discuss what shopping for insurance looks like.

Getting Insured

There is a lot of information out there on the internet, but what you don't want to do when you're looking to get insured is fling a bunch of online applications out into the ether without talking to a broker first. Ideally, you should develop a relationship with a trusted insurance broker who specializes in yacht insurance (not the broker who does your homeowners policy) early in the process of buying a boat. A good broker will ask you questions and anticipate each step and what you will need, saving you precious time. For example, if you're financing a boat, your lender will have deductible requirements that your broker needs to know before writing your policy to avoid costly delays.

It's important to be clear and honest about your intended goals with your broker: if you plan to live aboard your boat full-time, they need to know that to correctly place coverage and help you answer carrier questions. Some carriers won't insure liveaboards, and some define liveaboards differently. Your broker can help you understand what carriers need to see in your plans to avoid denied claims.

.png?width=898&height=449&name=unnamed%20(5).png)

How to Be Insurable

It's a tough market out there, and many carriers will not insure new yacht owners who have never owned a boat before. But even if your experience is limited, there are things you can do to make yourself more attractive to insurance carriers.

- Get experience. Take lessons, charter a boat, or spend time on friends' boats to build your boating resume. Insurance companies will look at you more favorably if you can demonstrate that you've made an effort to become a competent, safe boater. Chartering a boat is a great way to get a lot of experience in a concentrated amount of time. Three to four weeks can be enough to get a captain's sign-off that you know your way around a boat, but if you only have one week of experience, you're uninsurable

- Buy a newer boat. Older boats are seen as riskier and usually come with higher premiums or deductibles to reflect that. If you're financing a boat, this can cause issues with your lender's deductible requirements, so buying a boat 15 years or newer can help ensure that you have a smoother closing process.

- Create a specific hurricane plan. This should include where the boat will go in the event of a storm, how you will prep the boat itself in terms of stowing loose items, taking down sails, etc., and what your backup plan is if your primary plan falls through.

- Work with a good insurance broker who understands your goals and situation. A good broker can advocate for you with carriers and help present you as a potential boat owner in the best light possible. Remember: don't submit online applications before speaking to a broker, especially if you haven't owned a boat before. It's a bummer when a broker makes a phone call to a carrier to talk them through your experience only to find out that they already denied you through an online application and won't be able to give another quote.

Location, Location, Location

A huge factor in insurance premiums is where your boat will live most of the year, but most critically during hurricane season. Higher-risk locations mean higher insurance rates, so keeping your boat in Florida year-round is the most expensive option. North of the Georgia-Florida state line is where you start to see a reduction in rates, and the further north, the better, with North of Cape Hatteras being ideal come hurricane season. Going south of the Caribbean to the ABC islands of Aruba, Bonaire, and Curacao can also be a rate-reducing hurricane plan.

.png?width=898&height=457&name=unnamed%20(6).png)

Different types of boats can be more or less expensive to insure. Motorboats tend to have the lowest rates, with sailboats coming in second, followed by catamarans. In general, monohulls are easier to insure.

Preparing for a Storm

Even if you dock full-time in the Chesapeake, hurricanes can still wreak havoc north of Cape Hatteras. Insurance carriers want to know where your boat will go in the face of a storm no matter where you cruise, and how you plan to secure your boat. You need to have a clear outline of what steps you will take when a hurricane warning goes out. For both insurance carrier requirements as well as your peace of mind, it must be a plan that can be followed, because when a hurricane is bearing down on you, everyone is scrambling to take care of their own property; no one is going to be there to help you if you're not prepared.

Think through what you will do to prepare the boat itself. What items need to be stowed, what equipment should be secured, and what systems can be protected? Refer to your carrier guidelines to understand what preparations they particularly want to see, such as putting extra fenders out, taking sails down and stowing them, charging your battery to power the bilge pumps, and securing your boat to the dock properly. If you want your hurricane plan to be a haul-out, you need to know exactly who is towing your boat out of the water and where it is going. That means reserving a spot with a shipyard now and paying a retainer to save a spot for your boat.

If you plan to keep your boat in a marina, insurance carriers want to know which marina. How protected is it? How secure are your dock and the cleats? Does your marina allow boats to stay during a hurricane, or do you need a backup plan? Is your neighbor's boat secured? You may want to bake in a plan for securing nearby boats that could hit yours if their owners haven't been able to take care of their hurricane prep.

The last thing you or an insurance carrier wants is for your boat to be stuck at anchor in a hurricane, so you need to have a very clear plan of how you will avoid that nightmare scenario. Even if you are a full-time cruiser, you too must have a plan for where you'll take your boat in a hurricane.

The yacht life is a good life, and one worth properly protecting. The benefits of yacht ownership go hand in hand with the responsibilities of keeping yourself, your boat, and the property around your boat safe, whether the waters are calm or a storm is brewing. Working with a knowledgeable, specialized yacht insurance broker early on in your yacht-buying search can help set you up for successful boat ownership for years to come.

Get in touch with Hugo Hanham-Gross with any questions about boat coverage options and yacht safety from a yacht insurance broker's perspective. Email [email protected] to reach out. And from David Walters Yachts, we give Hugo a hearty thank you for sharing his time and expertise with us!

LEAVE A COMMENT

Latest posts.

Start Your Next Adventure

Send us a message.

Purchasing a bluewater vessel can be a daunting prospect, especially if it’s your first boat. When you work with a dedicated DWY broker, you benefit from our team’s 200+ combined years of maritime experience.

- Skip to main content

- Skip to primary sidebar

- Skip to footer

The Boat Galley

making boat life better

Making a Hurricane Plan for your Insurer

Published on March 28, 2020 ; last updated on April 27, 2022 by Carolyn Shearlock/Laura Lindstrom-Croop

Do your cruising plans have you traveling in the hurricane zone? Then your insurance company will want you to file a hurricane plan.

Laura Lindstrom-Croop shares the information you’ll need to include to keep your insurance company happy and your boat safe. This is the fourth in her series on understanding insurance when you live on a boat.

Check out her previous posts:

- Are You Insured for Strangers on Your Boat?

- Insurance When You Live on a Boat: Where To Start

- Boat Insurance: Hull Values and Premiums .)

Twenty years ago, insurance companies did not ask cruisers to fill out hurricane plans. What information will you need to provide in yours? And why are they requiring them now?

What is a Hurricane Plan?

If you plan to cruise in an area where hurricanes strike, your insurance company will want to know you have a plan in place to keep your boat safe. They may give you a form to complete.

Whatever format you use, you’ll need to detail where you’ll take your boat in case of a storm and how you’ll secure it.

Why Insurance Companies Require Hurricane Plans Now

Several things have changed during the last decade or two.

There are many more boats, and boats are much more expensive. Most cruising boats used to be under $100,000. Now the average is probably closer to $250,000. This increased financial risk has resulted in larger and larger losses when a hurricane strikes a populated area.

As actuaries study the data gathered after a hurricane, insurance companies realize that the way an owner prepares their boat makes a huge difference in the amount of damage it sustains. So, it follows that companies want to know what your plans are in the event of a hurricane, thus the “Hurricane Plan” form.

Since no two harbors are alike, the hurricane plan allows you to convey to the insurance company your plan based on where you will be.

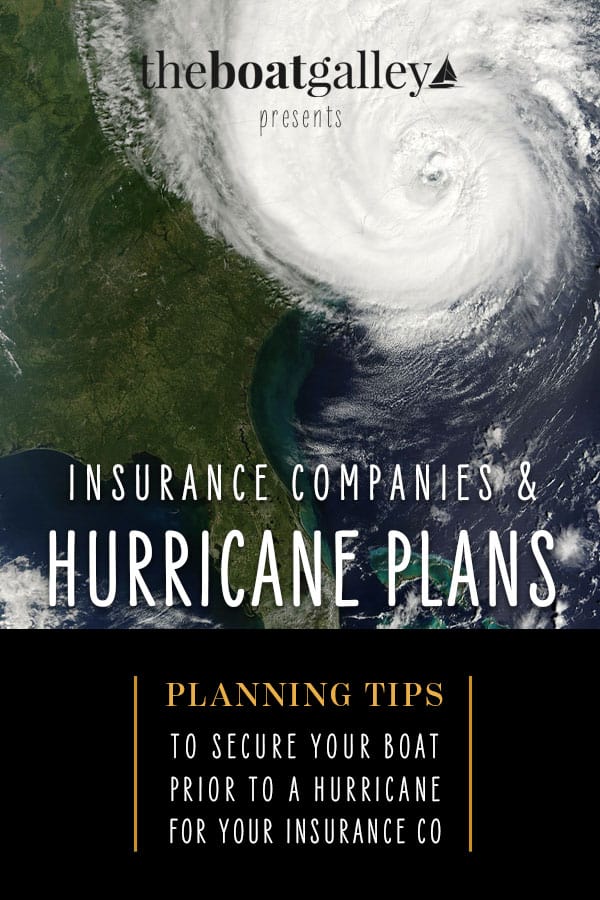

Securing Your Boat

If you choose to leave your boat in a hurricane zone there are two main ways to secure your boat in the event of a named storm.

One is to haul it out and store it “on the hard.”

This has proven to be the safest method of storage if the jack stands are chained together and the stands are on sheets of ¾ inch plywood or on concrete. You must also strap your boat down either to eyes in the concrete or to helical anchors. The straps should not have any stretch to them.

The second method is tying to a dock.

This method can lead to damage if you don’t tie your boat up properly. Data show that up to 50% of damage to boats at the dock during a storm could have been prevented with better dock line placement, larger lines, and chafe protection.

You need to double your lines and add chafe guards before the hurricane arrives . You can determine the appropriate diameter and number of lines based on the size of your boat.

For example, one company recommends:

Boats 31-45 feet use 12 lines at a minimum of 5/8 inch diameter.

Boats 45-60 feet use 16 lines at a minimum of 3/4 inch line.

Form a spider web of lines with some long and some short. Tie around a piling instead of to a cleat that could pull loose from the dock. Fire hose works great as chafe protection.

In addition to knowing how you plan to secure your boat, your insurance company will need additional information on your hurricane plan.

Information to Add to Your Hurricane Plan

Your insurance company will also require the name, address and phone number of a person you make responsible for communication after the hurricane.

If you are not going to be on the island, or near your boat, it helps to have a person near your boat who can be your contact after the storm. He or she can report to you and the company about how the boat came through the storm, provide pictures, and if need be, arrange for getting repair estimates.

If you are away from your boat and it suddenly needs to be moved it is also good to authorize someone you trust to move your boat. You might choose a dock master or another cruiser who lives in the marina or nearby.

Regardless of who you choose, you want to make your choice in advance of a storm.

Depending on your area some companies may want to know your back up plan. When a hurricane is approaching your area your local yard may be full. So what would you do then?

Or what happens if your marina says you must leave! Can you get to a hurricane hole? It is best to have a plan ahead of time so you don’t have any last-minute surprises.

Last Hurricane Prep Tasks

Don’t forget common sense things like removing all canvas and sails and any other loose items on the deck . Most companies will not cover sails or canvas left out so take it all down and store down below.

Some companies recommend sealing all ports, windows, and hatches with tape to prevent driving rain from entering and causing water damage down below.

One other good idea is once you have secured your boat take pictures of all your preparations so you can prove that you complied with everything as you said you would.

Submit Your Hurricane Plan to Your Insurer

So, to wrap this up, don’t be afraid of the hurricane form.

Fill it out as best you can. Don’t say you are going to do something that you can’t do. Be honest about what your plans are.

If the company is not happy with your plan they will say so, and you can revise it till both parties agree.

This form becomes part of your policy so it’s legal and binding. It is a good way to prepare calmly for an event you hope will never happen. But if the worst happens, you can get your plan out and use it to get ready for the storm.

I hope this helps you understand why the company wants the hurricane plan. And why it’s a good thing for you also to use as a guide when the storm is headed your way. Let’s hope we all have a quiet hurricane season!

Laura Lindstrom-Croop has worked as a Claims Adjuster and as an Insurance Agent for over 35 years. She brings a unique perspective to the insurance business as a liveaboard cruising sailor with an Atlantic crossing and over 20,000 miles under her keel over the last 12 years. Her current cruising grounds are from New England to Trinidad. Laura currently works for International Waters Insurance Services , an independent broker that specializes in marine coverages. If you have questions you’d like Laura to address in future posts, leave a comment below or email her at [email protected] .

And check out our other courses and products

Find this helpful? Share and save:

- Facebook 209

- Pinterest 17

Reader Interactions

Leave a reply cancel reply.

Your email address will not be published. Required fields are marked *

Each week you’ll get:

• Tips from Carolyn • New articles & podcasts • Popular articles you may have missed • Totally FREE – one email a week

SUBSCRIBE NOW

- Questions? Click to Email Me

- Visit Our Store Cruising Guides Living on a Boat Courses Books & References

- Boat Reviews

- Press Releases

Hurricane Plan 101: Insurance Requirements

Hurricane season is upon us and if you own a boat, you will need to devise a comprehensive storm plan. The sooner you do this, the better. Generally, your marine insurance company will require that you submit a Named Storm Plan. What this plan does is tell the insurance company what you plan to do with your yacht, should there be a named storm approaching. And while the threat of a tropical storm is never a good thing, having a plan is what makes the situation manageable.

When my clients are asked by their insurance company to submit a Named Storm Plan, I am happy to help. I provide a list of what needs to be done to ensure the yacht is prepared in the event of a named storm, and then review it with the yacht owner so that they understand everything that I have listed. In this blog post I am going to provide you with that list, as well as shed some light on marine insurance policies.

Hurricane Season and Insurance Companies

Hurricane season runs from June to November, with the most active part of the season occurring from August to September.

If you own a catamaran, most yacht insurance companies will require that the vessel be north of 30.5 degrees longitude or south of 10 degrees north latitude from July 1st to November 1st. As a yacht owner, should you decide to keep your yacht in the Hurricane box during this time frame, the insurance premium will be higher. The standard deductible may not go up, but if the yacht is located in the box during hurricane season, the named storm deductible could be 15-20% in the event of damage caused by a named storm. Additionally, you will need to submit a Named Storm Plan. See the example below.

Storm Plan for Insurance Company

The vessel will be secured in the following manner:.

- All bow, stern and spring lines will be fitted with chafe gear, doubled as needed

- Roller Furling Genoa will be removed and stored below

- Main sail and main sail cover will be storm tied

- Any cockpit or helm canvas removed or rolled up and secured

- Secure tender, remove outboard engine if possible

- All fenders will be deployed, fender boards added if needed.

- Batteries will be fully charged

- All electric and manual bilge pumps will be tested and operational

- All hatches will be secured and locked

- All exterior gear removed

- All running rigging removed or secured

- All helm electronics tested operational and covered

- All sea cocks checked for ease of closing if needed

- Wooden plugs available for each thru hull fitting.

- Fuel tanks checked for sufficient fuel as needed

- Engines checked, run, and tested

- If generator is fitted, checked, run, and tested

- Monitor local and national weather services including VHF, TV, and internet. Keep in touch with other boat owners in the area.

Extra precautionary measures to be taken if yacht is at a private residence:

- Double lines secured to two different strong points on yacht and ashore to pilings and/or trees where possible.

- Check area for loose items such as patio furniture which could damage yacht.

- Lines may be tied across the canal to keep the yacht at least 10’ away from the dock and able to rise and fall with the tide and any surge.

- Yacht’s anchor may be deployed if deemed it would be of additional security.

Can some else be responsible for your yacht?

Yes, you may put someone else in charge of preparations. Perhaps you have left your boat in Florida, the Bahamas or Puerto Rico during the hurricane season, but you are not there to prepare for the storm yourself. Your insurance company will require the contact information for the company or person(s) that will be responsible if you are not present to prepare your yacht. You must also keep the insurance company informed of any changes in location, or inform them if you have plans to place your yacht in dry storage rather than at a dock. If on land, they will require specific storage details, such as supports and tie-downs.

Proper preparations are the best ways to ensure your yacht is safe in the event of a storm. If you have any questions about how to keep your catamaran secure during hurricane season, please contact me today.

Topics: Boat Buying Process

Subscribe Here!

Yacht Dreaming

Understanding Boat Insurance and Hurricane Box Maps

What is Boat Insurance?

Boat insurance is a type of insurance that covers the costs of damage, loss, or theft of boats, yachts, and other watercraft. This coverage is important for boat owners because it can protect them financially in the event of an accident or disaster.

Boat insurance policies can be customized based on the owner’s needs and budget. Some policies may only cover liability, while others may include coverage for damage to the boat, personal property, and medical expenses.

Why is Boat Insurance Important?

Boat insurance is important because it provides financial protection to boat owners in case of unexpected events such as accidents and natural disasters like hurricanes. Without proper insurance coverage, boat owners may face significant financial losses.

Types of Boat Insurance Coverage

There are several types of boat insurance coverage that boat owners can choose from. These include:

- Liability coverage: This type of coverage protects boat owners if they are responsible for causing damage to another boat or injuring someone while operating their boat.

- Collision coverage: This type of coverage provides protection for damage to the boat caused by collision with another boat or object.

- Comprehensive coverage: This type of coverage protects the boat against damage or loss caused by events such as theft, fire, or natural disasters.

- Uninsured boater coverage: This type of coverage protects the boat owner in case of an accident with an uninsured or underinsured boater.

Understanding Hurricane Box Maps

A hurricane box map is a tool used by boat owners to help protect their boats during hurricane season. The map shows the areas where hurricanes are most likely to occur and provides guidance on the safest locations for boats during a hurricane.

The box map is used to track the progress of hurricanes and determine where they are likely to make landfall. Boat owners can use this information to move their boats to a safer location outside the hurricane box.

How to Choose the Right Boat Insurance

It’s important to choose the right boat insurance policy to ensure that you are fully covered in the event of an accident or disaster. Here are some tips for choosing the right policy:

- Consider the type of boat you have and its value.

- Determine the level of coverage you need based on your budget and risk tolerance.

- Research different insurance providers and compare coverage and rates.

- Read the policy carefully and make sure you understand what is covered and what is not.

Tips for Protecting Your Boat During Hurricane Season

In addition to having the right boat insurance coverage, there are other steps you can take to protect your boat during hurricane season. Here are some tips:

- Create a hurricane plan and make sure everyone on board is familiar with it.

- Check all lines and anchors to ensure they are secure.

- Remove all loose items from the boat and store them in a secure location.

- Close all hatches and ports.

- If possible, move the boat to a safe location outside the hurricane box.

Boat insurance is an important investment for boat owners, especially during hurricane season. Understanding the different types of coverage available and taking steps to protect your boat can help you avoid financial losses and ensure the safety of your boat and its passengers.

Boat Tours Jekyll Island: A Spectacular Experience

Everything You Need to Know About Boat Storage in Kingston, OK

© 2024 Yacht Dreaming

- Search Used Yachts For Sale

- Search Boats By Brand

- Search Boats By Type

- Search By Location

- Search By Price

- What's My Boat Worth?

- Search Boats Just Listed

- Small Yachts

- Custom Sport Fishing Boats

- Finance A Boat

- Amer Yachts

- Cabo Yachts

- French Yachts

- Gulfstream Yachts

- Hatteras Yachts

- Solaris Yachts

- Sunpower Yachts

- Sunreef Yachts

- Vela Boatworks

- Virtus Yachts

- Why List With United?

- Why Own A Boat Or Yacht?

- Custom Website For Your Yacht

- United Sold Boats

- Buy A Yacht With Crypto

- Find a Yacht Broker Near Me

- Search For Broker By Name

- Meet The United Support Team

- Our History

- Fort Lauderdale Boat Show

- Stuart Boat Show

- Miami Boat Show

- Palm Beach Boat Show

- Other Boat Shows

- Yachting News

- Yacht Closing Services

- River Forest Yachting Centers

Search All Yachts

How Do You Protect A Yacht From A Hurricane?

By Robert Bowman | Posted On Jun 23, 2022 Updated On Nov 10, 2022

If you live anywhere along the coast, preparing for hurricane season is a normal, annual occurrence that becomes a bit more challenging when you also own a boat. If you're a yacht owner and cannot easily secure or move your vessel, the stakes become even higher. Anyone in doubt of the severity of the damage done to boats need only look back to Hurricane Sandy, which damaged more than 65,000 vessels according to Boat U.S.

Forecasters for the Climate Prediction Center, a part of the NOAA , announced that there is a 65% chance for a more active hurricane season from June 1st through November 30th. If you are new to owning a yacht or haven't had to deal with an active hurricane season before, below is advice we have compiled from the experts.

What To Know About Hurricanes & Yacht Insurance

If there is anyone that knows a thing or two about hurricanes and the rules about your boat insurance, it's Michael Boyer, Senior Vice President of the Marine Division at Brown & Brown Insurance. Michael has been specializing in marine insurance for years and knows how to navigate hurricane season. We asked Michael 3 of the most common questions associated with boat insurance and hurricanes.

1.) What should boat owners do with their insurance company before hurricane season?

It is imperative that they review their policies, specifically their storm plan so that they can be reminded of what is required of them in the event of a storm. Some policies require that the vessel be hauled out of the water and put on the hard, while other policies have warranties that the vessel may not be more than 100 miles from the scheduled location. Additionally, most policies have a hurricane haul-out reimbursement coverage that will reimburse the insured up to a certain amount for the costs to haul the vessel out of the water. Some go as far as to help pay for additional lines, anchors, and even the labor cost associated with preparing the vessel for the impending storm.

2.) If a storm is coming, what should a yacht owner do in regards to their insurance company?

The insured should be sure to stow all canvas & upholstery items and add additional lines. If the boat is to be hauled, the insured should make sure that they provide the yard with adequate time to haul the vessel. They need to remember that these yards will cease operations prior to the storm approaching, so if the insured waits too long they may be out of luck. It is important to note, many of the yards require a contract in place prior to hurricane season and if the insured does not have one, they may be forced to leave their vessel in the water. Yards fill up quickly and there isn’t enough room to accommodate all vessels.

3.) If a boat owner does incur a loss, what are the first things they should do?

In the event of a loss, it is important to document all damage by taking as many as thorough photos as possible. Additionally, it is the insured’s responsibility to take whatever reasonable measures possible to avoid further loss. After both of these requirements have been satisfied, it is important to contact your agent and file a claim. Patience will be needed as the carriers will be handling a high volume of claims if the storm is severe.

What Advice Do Our Professional Yacht Brokers Give Their Clients?

Many of our professional yacht brokers at UYS have been in the business for decades and have gone through countless storms, all while advising their clients on what to do. Who better to call than the person that sold you the boat to ask for advice?

Greg Graham : It’s been my experience that the insurance company’s want to have their insured assets out of the water if possible because the biggest potential issue when a storm hits is the boat sinking. They have a much better chance of sinking than they do falling off of the jack stands on the pavement. With the particular client I personally manage, if a storm is eminent we try to haul all 4 inboard boats and put the outboard boat on the trailer. The hauled boats have their eisenglass and out riggers removed and the exterior hatches taped up…then we pray a lot. lol

Michele Renick : I always keep several update-to-date storm preparedness checklists and guide that I can forward to my clients during this time of year. Some of them are from organizations like Boat U.S. and service yards like Hinckley. Together, the checklists give you a really thorough plan on what to do. Things like checking all AC units, topping fuel off in all machinery, double-checking all hatches, etc. are included. Of course, the best advice to give is to just get ahead of any potential threats.

Christopher Cooke : The best advice I ever give my clients is to buy a pre-paid haul out plan. This is the only way to make completely sure you have a haul out and a spot. It usually costs 50% of a haul out and prep price. You don't get it back if nothing happens, but you are 100% guaranteed a spot. Better safe than sorry with an investment like a yacht.

River Forest Yachting Centers Are A Preferred Partner Of United Yacht Sales

The Hurricane Club at the River Forest Yachting Center is a feature every yacht owner should consider. The Hurricane Club was created to offer boat owners a place to bring their yacht or store their boat during hurricane conditions. "By joining the Hurricane Club®, you will be entitled to wet or dry boat storage in RFYC’s hurricane-protected freshwater locations in both Stuart and LaBelle. Both locations strap the boats down to aircraft tie-down cleats in LaBelle and augers in Stuart. These inland locations, with convenient access to the Atlantic Ocean, Lake Okeechobee and the Gulf of Mexico, make RFYC the ideal solution for hurricane refuge."

Do Finance Companies Stop Lending Money During A Hurricane Threat?

Our preferred marine finance partner, Shana White of OceanPoint Marine Lending has helped clients finance their boat purchase before, during, and after hurricanes. "Financing a yacht is generally not affected during hurricane season," says Shana. "The only time it becomes a burden is when there is a hurricane in the area and they have to shut off all binding of insurance policies. This means we cannot close on the loan until after it passes and insurance resumes.

United Yacht Sales has over 250 yacht brokers worldwide creating the largest network of boat buyers and sellers in the industry. Together with our preferred boating partners , we can help you with every aspect of your boating life from the purchase process, listing it for sale eventually, and continuing the relationship onward. Our focus is always on our clients, not new boats or trade-in boats we own. If you ever have a question about buying or selling a yacht, don't hesitate to call our friendly staff at 1-772-463-3131.

Interesting Boating Links

Worldwide yacht sales.

- Nj Yacht Sales

- Sailboats For Sale Virginia

- 30 Million Dollar Yacht

- Beaufort Yacht Sales

- Yachts For Sale Portland Oregon

- California Yachts

- Yachts For Sale in Kemah Texas

- 4 Million Dollar Yacht

- $500000 Yacht

- Used Boats For Sale Canada

- Trawlers For Sale NC

Luxury Boats & Yachts

- Prestige Yachts For Sale

- Bertram For Sale

- Used Boats Near Me

- 60 Ft Yacht For Sale

- Viking Boats For Sale

- Ocean Boats For Sale

- Hinckley Boats For Sale

- Cabo Boats For Sale

- Azimut Yachts For Sale Florida

- Great Loop Boats For Sale

- Yachts For Sale Near Me

Popular Builders & Models

- Albemarle For Sale

- Offshore Racing Boats For Sale

- Used Catamaran For Sale

- Sea Ray 400 Sundancer For Sale

- Pilothouse Motorsailer Sale

- Used Edgewater Boats For Sale

- 44 Sea Ray Sundancer For Sale

Trending Brands & Types

- Luhrs Boats

- Used Bay Boats

- 65 Estrella Price

- Hatteras Sportfish For Sale

- Nordhaven Yachts

- Vanquish Boats For Sale

- Regal Boats Prices

- Richie Howell

- Henriques Boats For Sale

- Legacy Yachts

- Magbay Yachts

- Ocean Reef Yachts For Sale

SEND UYS A MESSAGE

Recent posts.

Mar 05, 2024

Cloud Yachts Joins United Yacht Sales

Yachts For Sale Near The 2024 Palm Beach Boat Show

Mar 01, 2024

The Hot List - March 2024

Feb 14, 2024

Two Superyachts Added To United Yacht Sales Listings This Week

- BOAT OF THE YEAR

- Newsletters

- Sailboat Reviews

- Boating Safety

- Sailing Totem

- Charter Resources

- Destinations

- Galley Recipes

- Living Aboard

- Sails and Rigging

- Maintenance

- Best Marine Electronics & Technology

How to Navigate Marine Insurance in 2021

- By Jennifer Brett

- Updated: June 30, 2021

If you’ve been on the hunt for a marine insurance policy over the past year or so, you likely already know that it’s a challenging market. Sailing and cruising groups on social media and web forums are filled with frequent posts about people struggling to find coverage, keep coverage, or just afford it. It’s a problem that seems to be affecting beginning cruisers and circumnavigators, with old boats or new. So what gives? How did the situation get to this point, and what can sailors do to protect their dream?

“I’ve been doing this for 30 years, and I’ve never seen a market this hard,” said Morgan Wells, a yacht-insurance specialist with Jack Martin and Associates. “There’s been a great reduction in the number of insurance companies writing boat and yacht insurance, and the international-cruiser segment of the market has been more adversely affected, particularly for boats anywhere on the US East Coast, and even more so for people looking for new policies for Florida, the Bahamas and the Caribbean.”

Indeed, cruisers across the spectrum of locations and sea time are feeling the pinch. When looking to renew their current insurance policy last year, circumnavigators Behan and Jamie Gifford, who live aboard their 1982 Stevens 47, were met with a surprise. “When it came time to renew, we were quoted more than double our cost for insurance the year we planned to cross the Indian Ocean, 2015—an arguably very risky navigational area—and we now had the added requirement of a third adult for passages,” Behan said. “In the end, we didn’t renew at all, and currently have liability-only insurance. I’m not pleased about that and hope to get back to full hull insurance when the market comes around.”

Owners of newer boats don’t seem to be having an easier time either. “We bought a 2015 Jeanneau 64 in October 2020,” Dan Stotesbery said. “I have a lot of experience sailing, but none of it was logged, so I don’t have any credentials like a Yachtmaster or anything like that. My wife has even less experience. When we heard it was tough getting insurance, we were definitely worried about getting covered. Complicating the situation was that the boat was in Turkey, and I needed to sail it across the Atlantic to get to my wife and family. We reached out to the company that insured our house to see if they could find us a company that would insure the boat and especially the crossing. We received two quotes back and ended up getting insured with Concept Special Risk. They did put in a lot of stipulations, like we needed to have a captain for the crossing and at least two other people with bluewater experience, a list of countries we aren’t allowed to go in, and a 250-miles-from-land limit once the crossing was complete. It was extremely expensive, and there was an additional cost for the crossing.”

Changing Marketplace

So how did it get to this point? “We need to put it into context of a market that was very soft for many years—underwriters were looking for business,” Wells said. “There was a bit of a hiccup in the mid-2000s with some fairly significant storms, but generally it didn’t cause much change, and underwriters were still looking for ways to say yes. But then in 2017 came hurricanes Irma and Maria, then Dorian in 2019—these were extremely large losses to very large fleets of boats. Since 2017 we have seen the market flip from a soft to a hard market, and in fact, a very hard market by early 2021. We really have a big change now with fewer insurance companies and greater demand for insurance. And the pricing is much higher than it was a year ago. Irma and Maria showed the vulnerability in the market.”

Laura Lindstrom-Croop from Legacy Underwriters, noted that “many insurance companies left the Caribbean market in 2019-20. Pantaenius America was the first to leave,” she said. “The agency that I work with had YachtInsure, which lost its underwriter, Aspen Insurance, last summer. They have recently secured a new carrier, Clear Blue Specialty, that is writing new business but has new guidelines. Our second underwriter, Concept Special Risk, lost its company, Great Lakes Insurance, on January 1, 2021, but now it has a new company, Clear Springs Property and Casualty, that is writing new business with new guidelines.”

Suzanne Redden, mid-Atlantic branch manager for Gowrie Group, has had a similar experience. “Traditionally, when we would have someone coming in with a sailboat who wanted to do extended cruising, we had five, six, seven…at least that many companies who were willing to write that policy,” Redden said. “So there really wasn’t too much of an issue finding coverage for the customer, depending on where they wanted to go and their level of experience, that sort of thing. What we’re really struggling with now—and it’s a struggle—is that so many carriers have basically pulled out that our options are very limited as far as who is willing to write Caribbean navigation and worldwide navigation. Our choices are few. And what happens then is, of course, the prices go up because the company’s philosophy is ‘no one else wants to write here; we’ll write here, but this is what our actuaries tell us it’s going to cost to allow us to do that.’ So that’s why the rates have gone up.”

The cost to insure his Jeanneau 64 was definitely a bit of a surprise to Stotesbery: “The policy had to be paid upfront. That was the biggest surprise to us because we are used to paying car insurance monthly. This is also a hurdle that I think can be hard to overcome for some people. Not a lot of people have that kind of cash on hand to just fork out.”

Read More: How-To

Underwriting Difficulties

Along with higher costs, Redden also pointed out that the underwriting has changed a lot too. “Where before you would have had somebody who maybe had just a year or two experience, or they had just bought a boat, more companies would have been willing to let them take a trip. They look at it much more closely now when a new submission comes in. That’s made it more difficult, I think, for that sort of person to find insurance.”

According to Emma Whittemore, a service manager for BoatU.S./Geico Marine Insurance, underwriting has become much more sophisticated. “With the growth of data, insurance companies can really tell what group is a high-risk group,” she said. “We’re monitoring a lot more to make sure that the right people are behind the helm on these big, 35- to 60-foot boats. We want to make sure it’s not these customers’ first boat, and that they really know what they’re doing. Underwriting is fluid, but in general we always like to look at the ownership experience.”

This has been a particularly vexing problem for potential cruisers. Dana Fairchild and her husband live in Minnesota and have been planning for their cruising dream for the past few years. The couple has taken ASA sailing courses and chartered on Lake Superior but never owned their own sailboat. “Our cruising plans are to buy a boat large enough to live aboard; a 35- to 38-foot Island Packet is what we have in mind,” she said. “Due to the price point of Island Packets, we are looking at models from the 1990s. We plan to keep it on the East Coast of the US—somewhere above the hurricane zone during hurricane season, and probably down to Florida in the winter—for the first six months to a year while getting comfortable with the boat and used to the liveaboard lifestyle. After that we want to head to the Bahamas for a while, and eventually work our way down to the rest of the Caribbean and stay there.”

While the couple hasn’t purchased a boat yet, they’d heard the news that insurance might be difficult to find, so they reached out to a few companies to explain their plans and intended boat. “The short answer to what we’ve been hearing from insurance agencies is no. The reason for this is predominantly that we have not owned our own boat that is of comparable size, or at least within 10 feet. They don’t take into consideration that we have sailed and chartered boats of the same size, but really only want to see that a boat of comparable size was titled to us for at least two years”

Looking Ahead

So when faced with a denial, a notice of nonrenewal or a steep increase in premiums, what can a cruiser do? Is there coverage available? “What I am seeing, you have more choices if you limit your cruising to the US East Coast down to the Turks and Caicos,” Lindstrom-Croop said. “If you go to the Eastern Caribbean, you have fewer carriers, and some are writing coverage that doesn’t include hurricanes.

“I think cruisers are going to have to be patient and flexible. Also, update your sailing resume so when you shop around, you are giving the company a reason to give you the maximum credit available. Lower rates are probably not going to happen for a couple of years, climate change is weighing heavily on insurers, and the large number of storms recently is worrisome.”

Communication is crucial. Each of the insurance professionals I spoke with made it clear that underwriters are looking much more closely than in years past, and detailed sailing resumes and hurricane plans can help your chances. For newer cruisers, scaled-back sailing plans could help as well because finding coverage for a smaller cruising area will likely be much easier than, say, the entire East Coast and Bahamas. And for older vessels, a survey might be required for renewal.

“Some of the companies have gone to where they won’t write a boat over 40 years old,” Redden said. “Gowrie Group offers the Jackline program, which is a cruising program through Markel Insurance, which is really one of the last US companies still doing extended cruising, but they’re very restrictive on what they will write and how they’ll write it. But they will take older boats. Experience is the key.”

“It is harder to insure an older boat, but it can be done,” Lindstrom-Croop said. “There are just fewer markets. An older boat needs to be maintained well and have a current survey, within three years. I like to submit the survey along with the application when marketing so the underwriters can see the boat.”

For the time being, it seems that cruisers, such as Stotesbery, who currently have—albeit expensive—coverage are doing what they can to keep it. “We have had several major repairs to do on the boat, which we probably could have put in a claim for, but we are too worried about getting dropped or not covered next year, so we just paid for the repairs,” he said. “So it’s sort of a Catch-22. Unless we have a catastrophic type of claim, we don’t want to make one, but we still pay the high premium without really being able to take advantage of the protection. We will definitely start shopping again once we get closer to our renewal date. Unfortunately, there just aren’t a lot of insurance choices out there, so it is quite limiting, and they hold all of the cards.”

Others, such as the Giffords, are going without full coverage for now, while potential cruisers, such as the Fairchilds, might need to put their dream on hold. “As for how this is impacting our plans, it has really made us start to second-guess that this is even a possible plan. We have become discouraged, and this has really put a halt to most of the steps we were taking,” Fairchild said.

Wells, Redden and Lindstrom-Croop are optimistic for things improving in the insurance market over the next year or so, but all emphasize having patience. “We’re hoping that things will change for the better,” Redden said. “We’ve got some companies now that pulled out that are coming back, but it’s a very slow process.”

Jennifer Brett is CW’s senior editor.

- More: Hands-On Sailor , How To , marine insurance , news , print 2021 may

- More How To

3 Clutch Sails For Peak Performance

It’s Time to Rethink Your Ditch Kit

8 Ways to Prevent Seasickness

How To De-Winterize Your Diesel Engine

Kirsten Neuschäfer Receives CCA Blue Water Medal

2024 Regata del Sol al Sol Registration Closing Soon

US Sailing Honors Bob Johnstone

Bitter End Expands Watersports Program

- Digital Edition

- Customer Service

- Privacy Policy

- Email Newsletters

- Cruising World

- Sailing World

- Salt Water Sportsman

- Sport Fishing

- Wakeboarding

Hurricane To-Do’s – Are You Ready?

Prepare your boat(s) to ride out the storm and make sure you are financially ready to ride out the storm with proper insurance on your boat(s). As the hurricane season churns into full swing, it is important to prepare yourself, your family, and your boat for the worst. Please read our list of the most important things to do before a hurricane comes your way.

Develop a detailed plan of action to secure your vessel in the marina (if permitted). Alternatively, you may remove your boat from the threatened area or take your boat to a previously identified storm refuge. Specifically identify and assemble needed equipment and supplies. Keep them together and practice your plan to ensure it works before the hurricane season. Arrange for a qualified and capable friend or a licensed professional captain to carry out your plans if you are out of town during the hurricane season.

Owners of non-trailerable boats in wet storage have options that include the following:

- Secure the boat in the marina berth;

- Moor the boat in a previously identified safe area; or

- Haul the boat.

Owners of boats remaining in a marina berth can take the following precautions: Double all lines. Rig crossing spring lines fore and aft. Attach lines high on pilings to allow for tidal rise or surge. Make sure lines will not slip off pilings. Inspect pilings and choose those that appear the strongest and tallest, and are installed properly.

Cover all lines at rough points or where lines feed through chocks to prevent chafing. Wrap with tape, rags and rubber hoses or leather. Install fenders, fender boards or tires if necessary to protect the boat from rubbing against the pier, pilings and other boats.

Fully charge the batteries and check to ensure their capability to run automatic bilge pumps for the duration of the storm. Consider backup batteries. Shut off all devices consuming electricity except the bilge pumps, and disconnect shore power cables.

Secure, secure, secure. Lash down everything you are unable to remove such as tillers, wheels and booms. And after you have made anchoring or mooring provisions, remove all portable equipment such as canvas, sails, dinghies, electronics, cushions, biminis and roller furling sails.

Do not stay aboard. Winds, during any hurricane, can exceed 100 mph and tornadoes are often associated with these storms. Above all, safeguard human life. Climate experts at the National Oceanic and Atmospheric Administration (NOAA) continue to predict active Atlantic Hurricane seasons in the coming years. We could experience several named storms each year, a few of which may have the potential to become major hurricanes. These predictions reinforce the need for boaters in hurricane-prone regions to have preparation plans in place. Boat owners and the marine community should take proactive measures to minimize the potential for injuries and damage to their boats and other property. Remember, key factors in protecting your boat from hurricanes or any severe storm are planning, preparation and timely action.

Check your lease or storage rental agreement with the marina or storage facility. Know your responsibilities and liabilities as well as those of the marina.

Maintain an inventory of both the items removed and those left on board. Items of value should be marked so that they can be readily identified. You should also consider maintaining a video or photographic record of the boat and its inventory in a secure location other than the vessel itself for future reference.

Consolidate all records including insurance policies, a recent photo of your vessel, boat registration, equipment inventory, and the lease agreement with the marina or storage facility. Ensure that you include the telephone numbers of appropriate authorities, such as the U.S. Coast Guard, Harbor Master, National Weather Service, and your insurance agent, and keep them on hand.

For more information on hurricane preparedness, or to download a hurricane information pamphlet contact NBOA Marine Insurance at 1-800-248-3512 or visit www.nboat.com for details.

Read More About Your Boat Insurance Policy

- Go to our Boat Insurance Guide Homepage page to go back to the boat insurance basics.

- Go to our Physical Damage Coverages page to see what is covered in your boat insurance policy.

- Go to our Policies page to see what is NOT covered in boat come boat insurance policies.

- Go to our Boat Towing and Personal Property Insurance page to see what is covered in your boat insurance policy.

- Go to our Medical Payments page to read about medical liability insurance.

- Go to our Uninsured Boater Coverages page to read about uninsured boater insurance.

- Go to our Boat Insurance Rates page to check all the possible factors that affect your boat insurance rate.

- Go to our Boat Insurance Myths page to dispel some common misconceptions about boat insurance coverage.

- Go to our Boat Insurance Tips page for some helpful pointers on choosing the right boat insurance policy.

- Go to our Lay-up Coverage page to see why you should keep your policy active during the lay-up

- Go to our Theft Prevention Tips page to see how to best prevent your boat from being stolen.

CELEBRATING 25 YEARS AS ONE OF THE NATION’S TOP INSURANCE PROVIDERS!

Get a Your Insurance Quote

- We Are Hiring

- Naval Architecture

- Installations

- Seakeeper Extended Warranties

- Naval Architecture, Engineering & Construction

- All Speed 24VDC Fins Pricing

- Interceptor Pricing

- All-Speed Fin Stabilizer

- Custom-Shaped

- Jetboats Stabilization

- Stabilization

- Marine Electronic Innovations

- Yacht Management

- Antifouling Coatings

- Air Conditioning & Refrigeration

- Fiberglass, Gelcoat, & Paint

- Mechanical & Electrical Services & Repairs

- Haul Out & Dry Dock Services

- Schedule Demo Boat Ride

- Starboard Yacht Interactive Assessment

- Marine Electronics

- Seakeeper 1

- Seakeeper 2

- Seakeeper 3

- Seakeeper 5

- Seakeeper 6

- Seakeeper 9

- Seakeeper 16

- Seakeeper 18

- Seakeeper 26

- Seakeeper 35

- Fins & Interceptors

Protect Your Yacht from Hurricane Season Damage with Insurance

As someone living in Florida, you are well aware that this part of the country is one of the most affected by natural disasters over the course of the year. Tropical cyclones, also called hurricanes, are intense storms categorized by strong winds, torrential rains and floods.

Hurricanes can be absolutely devastating to an area, leaving total destruction in their path. Houses, commercial buildings, natural resources and much more can be severely damaged by these dangerous storms. Unfortunately, that also means that your personal property is at risk.

The 2018 hurricane season is expected to run through November 1, and Florida has already been hit with numerous disasters. Because these storms are so common, it is imperative that you protect your personal property in as many ways as possible.

Hurricanes and boat insurance

As an avid boater, you know how much time and money you’ve put into your yacht. It would be absolutely devastating to dock the boat in a marina one day, only to return following a storm and find it damaged. Boat repair in Fort Lauderdale, FL can get expensive, especially considering the sheer extent of damage hurricanes can do.

Hurricanes have the potential to destroy even the largest boats on the market. High-powered winds, drenching rain and soaring waves can do a significant amount of damage to both the exterior design and the inner workings of your vessel. Plus, debris swept away by wind can leave gaping holes and wretched scrapes on the deck and sides.

The best way to protect your investment is by getting hurricane insurance for your boat. Not all boat insurance policies come with this coverage in the base plan, so you’ll likely need to inquire and specifically request it when finalizing your protection plan.

Talk with the insurance expert to make sure your boat is adequately covered, so that in the event of total hurricane damage, your boat can be repaired or replaced without costing you a large sum of money out of pocket. You will hopefully never need to use this insurance, but you will be very glad you have it if you do require post-hurricane boat repair.

Make sure you work with a yacht service that accepts your insurance

Unfortunately, you may encounter a situation in which you want to have your boat repaired, but the yacht service company refuses to accept your insurance. If you find this out too late, your insurance coverage will be useless and you could be out a lot of money.

Before selecting a company to handle your boat repair in Fort Lauderdale, FL, conduct some thorough research and ensure the company accepts your type of insurance. At the same time, check the company’s reviews and make sure it is a place you can trust to rebuild your boat back to its former glory.

Starboard Yacht Group LLC is your one-stop shop for boat repair

If your boat was recently damaged by a hurricane, make the right choice and bring it to Starboard Yacht Group LLC. Our team of yacht repair experts will be able to complete a comprehensive slate of services, from mechanical work and plumbing to detailing and cleaning, to make your boat look as good as new.

We accept all insurance types and can assure you that your yacht will be in careful and experienced hands.

Call us today to learn more!

Thank You! Your message has been sent.

Thank you your application has been received., privacy overview.

Service Locator

- Angler Endorsement

- Boat Towing Coverage

- Mechanical Breakdown

- Insurance Requirements in Mexico

- Agreed Hull Value

- Actual Cash Value

- Liability Only

- Insurance Payment Options

- Claims Information

- Towing Service Agreement

- Membership Plans

- Boat Show Tickets

- BoatUS Boats For Sale

- Membership Payment Options

- Consumer Affairs

- Boat Documentation Requirements

- Installation Instructions

- Shipping & Handling Information

- Contact Boat Lettering

- End User Agreement

- Frequently Asked Questions

- Vessel Documentation

- BoatUS Foundation

- Government Affairs

- Powercruisers

- Buying & Selling Advice

- Maintenance

- Tow Vehicles

- Make & Create

- Makeovers & Refitting

- Accessories

- Electronics

- Skills, Tips, Tools

- Spring Preparation

- Winterization

- Boaters’ Rights

- Environment & Clean Water

- Boat Safety

- Navigational Hazards

- Personal Safety

- Batteries & Onboard Power

- Motors, Engines, Propulsion

- Best Day on the Water

- Books & Movies

- Communication & Etiquette

- Contests & Sweepstakes

- Colleges & Tech Schools

- Food, Drink, Entertainment

- New To Boating

- Travel & Destinations

- Watersports

- Anchors & Anchoring

- Boat Handling

- ← Safety & Prevention

The next big named storm to make landfall is a question of when, not if. Coastal boaters should prepare because hurricane season is here . The more you know and plan ahead, the better your chances of protecting your boat and property.

In an average year, two hurricanes will come ashore somewhere along the Gulf or Atlantic coast, destroying homes, sinking boats, and turning people's lives topsy-turvy for weeks or months. Since 2016, the U.S. has been hit by four powerful Category 4 hurricanes of 130-mph-plus — Harvey, Irma, Maria, and Michael, which strengthened to a Cat 5 storm, the most powerful ever to hit the Florida Panhandle, and demolished 150 years of records. Florida is struck most often, but every coastal state is a potential target.

Experts predict that tropical storms will be stronger and contain even more rainfall in the future, coupled with higher water levels. Experts also warn that after a number of storm-free years, people in some of the vulnerable areas may become less wary of a storm's potential fury. But to residents of the Carolinas crippled by Florence, and people in Florida ravaged by Michael in 2018, the hurricane threat won't soon be forgotten.

Hurricane and Tropical Storm Information

The next big named storm to make landfall is a question of when, not if. Coastal boaters should prepare because hurricane season is here . The more you know and plan ahead, the better your chances of protecting your boat and property. Visit our extensive library of hurricane-preparation videos and read articles based on nearly four decades of knowledge from our BoatUS Catastrophe Team.

Hurricane Preparation Videos

BoatUS experts have compiled a helpful playlist of hurricane prep videos based on four decades of storm response. Video topics include how to make a fender board, how to set your boat's lines for an incoming storm, how to choose a marina for your boat to ride out a storm and much more. Get prepared today!

Downloadable Guides

The next big named storm to make landfall is a question of when, not if. Coastal boaters should prepare because hurricane season is here. In this special section, our editors have created a comprehensive guide to help you, step-by-step, protect your boat.

Download Guide

This Hurricane Preparation Worksheet lays out the steps for putting a plan in place and giving your boat the best chance of beating the storm.

Download Worksheet

Preparing a boat for a hurricane means defending against wind, rain, waves, and high water—all in proportions rarely experienced by boaters. Claim files from past storms show that damage is usually due to a combination of these factors.

Featured Articles

1. what to expect from a hurricane.

Preparing a boat for a hurricane means defending against wind, rain, waves, and high water — all in proportions rarely experienced by boaters.

2. Where To Keep Your Boat During A Hurricane

The best predictor of whether your boat will survive a hurricane is where it’s kept. Just as in real estate, the three most important considerations should be location, location, location.

3. How To Find And Fix Potential Breaking Points On Your Boat

The fate of your boat's security in a storm comes down to these essential and critical points in your defense strategy. Addressing them early could mean the difference between your boat surviving a serious storm, or breaking free, hitting hard objects, filling with water, and sustaining catastrophic damage.

4. How To Develop A Hurricane Prep Plan

It's said that every minute you spend planning saves 10 minutes in execution. When a hurricane threatens, you’ll be glad your plan is ready to go.

5. What To Do After A Hurricane

After a storm has passed and authorities are allowing travel, get to your boat quickly. It's your responsibility to protect your boat from further damage, and its equipment from theft, regardless of its condition.

6. Hurricane Prep Saves During Hurricane Florence

These boat owners aggressively prepped their boat for survival at the dock using proven techniques as powerful Hurricane Florence zeroed in. Here’s their dramatic firsthand story.

2023 Hurricane Season Recap

With 20 named storms, the 2023 Atlantic Hurricane Season will go down as tied for the fourth-busiest on record. Seven of those storms became hurricanes, three classified as “major,” meaning Category 3, 4, or 5. An average year sees 14 named storms.

There Was A Hurricane Coming To Town

There are moments in the boating life — and water over the floorboards is one of them — when problems can begin cascading, and every decision becomes crucial.

Inside A Cat-4 Hurricane

We've all marveled at NOAA's birds-eye images of tightly spun hurricanes, but have you ever wondered how it looks on the roiling seas?

How Not To Read A Hurricane Map

Maps shown in the media are often misunderstood. Be careful: Incorrect interpretation could leave you and your boat unprepared.

The 2020 Atlantic Hurricane Season Is Heating Up

Make sure you have your plan set because the latest prediction calls for an above-average season with 25 named storms and 9 hurricanes.

Storm Anchoring: A Success Story

Our Leopard 42 catamaran, Valiant Lady safely rode out three major hurricanes anchored in about 12 feet of water just off the Intracoastal Waterway in North Palm Beach, Florida. Here's how.

How To Convert UTC To Local Time

UTC is based on 24-hour military time and doesn't recognize local adjustments like Daylight Saving Time, so it's a very accurate no matter where you are in the world.

Hurricane Categories

Here's a quick recap of the Saffir-Simpson Hurricane Wind Scale and what it means for you when it comes to protecting your boat during a storm.

How Secure is Your Marina Likely to be in a Hurricane?

How some marinas are dealing with the problems of storm surge, hauling boats, and exposed locations ... What about hurricane plans?

Other Helpful Resources

- American Red Cross

- BoatUS Foundation and USPS Hurricane Preparation for Boaters Course

- Department of Homeland Security

- Florida Hurricane Debris Cleanup

- HSUS Disaster Plan for Pets

- National Data Buoy Center

- National Hurricane Center

- NHC Data Archive

- NOAA Local Tides and Currents

- NOAA Office of Response Restoration

- Small Business Administration Disaster Field Offices

- West Marine Hurricane Prep Supplies

Download the BoatUS App

The BoatUS mobile app offers hurricane alerts that are refreshed with every NOAA update to the forecast. Download the app now or update to the current version and opt-in to push notifications to take advantage of this feature.

We use cookies to enhance your visit to our website and to improve your experience. By continuing to use our website, you’re agreeing to our cookie policy.

Yacht Insurance: Know The Pitfalls!

Yacht insurance policies are different for every yacht owner. There is no “one size fits all” solution like with home or car insurance. So buying yacht insurance is quite a bit more daunting to research for coverage and price. While we all hope that insurance is something that we will never need to use, we expect the policy we choose to either fix the yacht or to be fairly compensated when needed.

However, from our own experience and according to a recent BoatUS report, you may not be entitled to a payout with some common types of claims. In this article we will discuss the most common things to look out for when choosing your insurance.

Before the closing of your yacht purchase, your lender will require you to have insurance on your vessel. If you are buying a pre-owned yacht, the lender will generally require a marine survey to use to establish base coverage from the value and replacement value reported on the survey. As a very general rule, the annual premium for private yacht use coverage is 1.5% – 2% of the declared hull value. So, a $100,000 yacht will cost $1,500 to $2,000 per year to cover for Florida-Bahamas “private” use. However, this varies from region to region. Yachts in charter will typically be covered under a “fleet” policy with preferential rates that differ for each charter management company.

Insurance for yachts has been getting harder to obtain because there are many more claims than before. And it’s not just because of hurricanes. Actually, some of the most common types of claims are lightning strikes (Florida and Bahamas) and “sinkings at the dock”. Because of all this, underwriters want to “personalize” the process much more than before and scrutinize every possible negative aspect of the application process.

Tips for Your Yacht Insurance Application Process

- Your Sailing Resume. Expound on your experience in “comparable boats”. If you only have experience with 15ft Boston Whalers and you want to buy a 60ft sailing yacht to cruise to Bora Bora, then securing affordable yacht insurance…or at all…will be difficult. Get some experience on a sailing boat similar to what you plan to purchase. Take some lessons, sail with friends’ boats, and and book bareboat charter being sure to log your hours. The very best way to provide this information is to keep a sailing resume up to date so that when yacht insurance renewal time rolls around, you can make a quick update with the latest new nautical miles or boat experience and hand it over to your broker to arm him or her with the information that enables them to go to bat for you.

- Detailed Description of Current State of Your Vessel. Having this information ready to hand over to your yacht insurance broker is an often-overlooked source of information that improves the accuracy of your coverage and if well-maintained with safety in mind, reduces rates. Much like your sailing resume, create a document or collection of documents and images that describes your boat in detail, calling out all safety features and any renovations or upgrades with dates. Include recent images as proof of these features. Remember, that yacht insurance buying is a very personal experience and the underwriter is looking for ways to assure risk of loss is the lowest possible. The lower the risk, the lower your rates.

- Declaring Your Navigation Area. Carefully declare your navigation area. The best thing to tell the insurance company is that the “navigation area” will be a relatively small area like Florida-Bahamas. (After all, you will, if you are smart, get sailing lessons to operate your new boat in relatively secure waters closer to home). Mention your experience in coastal waters or bareboat charters that have been further afield in more challenging sailing conditions than the navigation area you are declaring. Unfortunately your experience on inland lakes does not count for much. Underwriters don’t count experience in inland lakes unless that is where you will keep your boat.

- Mention Only Current Sailing Plans. Insurance rates vary depending on use and navigation area. If you plan on crossing the Atlantic in the distant future (outside of the policy period you are researching) or if you are considering but not yet committed to living on-board, don’t tell your insurance company now. You want your rates to reflect your current plans, not something you might do. Wait until your plans are 100% confirmed. You will likely owe an additional upcharge to cover the increased navigation area coverage. To save money, delete the old navigation area coverage and replace it with a new coverage area.

- Changing Your Navigation Area/Sailing Plans. When the you are ready to move outside the initial navigation area, note, that changing your navigational area during your policy period is not as affordable as it once was. It is best to plan ahead when you are renewing as that gives you the most flexibility in choosing the yacht insurance company that offers the best rates and coverage in that navigation area. If you lock in to a company that does not support South Pacific sailing with affordable rates, or at all, you will cause yourself much grief. If you have tentative plans to go outside your navigation area in the upcoming year, ask your broker during your insurance selection process about these additional areas without declaring you are going there. Do not put this on any application, but rather have an informal conversation. Even better, talk with your fellow cruisers and yacht owners! Knowing about whether your insurance company covers a contemplated use or area can give you an indication of upcharge costs and potential for coverage of that area.

- Seven Seas Cruising Association yacht insurance recommendations for cruisers

- Our yacht insurance recommendations .

- Relocate During Hurricane Season. Most boat insurance companies offer discounts for moving the yacht outside of the “hurricane belt” during the official hurricane season (June 1 to November 1), so make your hurricane plans for your boat early. You could save quite a bit of money. Just be sure you execute your plans and actually move the boat.

- Try to Work with Insurance Companies You Know. If you already have homeowner’s or auto coverage with State Farm, Allstate, Progressive, or another major insurer, explore the possibility of adding the boat to the policy. You may be pleasantly surprised, but these policies are usually only valid in the U.S. and Bahamas.

- Covering Personal Belongings. Cover your personal belongings with a separate policy, not under your yacht insurance. This is another good opportunity to reach out to your existing home/auto insurer to see what type of renter’s insurance they offer to cover your personal items aboard your vessel.

- Your Address Matters. Underwriters consider an address from a non-coastal state a red flag and considered you an “absentee-owner”, even if you are living on the boat and are really NOT an absentee owner. The address on the application is what counts. So, if you are from land-locked Iowa, do not list that address. Get a mailing address in Florida or another coastal state. Most cruisers get mailing addresses from a mail service where they get their mail sorted and forwarded to their next destination.

- Early Bird Gets the Policy at the Best Rates. Apply for insurance at least two weeks before you need it bound. Do not wait until the last minute. What used to take 45 minutes, now takes several days because underwriters are so, so very cautious. Note that this does NOT include your research time which probably takes at least a month so plan ahead so you have plenty of time to get quotes from several insurance brokers.

- Research, research, research. Get quotes from several yacht insurance brokers including at least one that specializes in your type of vessel and/or navigation area. If you already have a quote from an insurance company, let the broker know so time will not be wasted getting you a duplicate quote

A Few Insurance Terms To Know

Actual Cash Value: In the event of a total loss, the market value, determined by age and condition of the boat at the time of the loss. Boating industry reference materials (NADA Book, BUC Used Boat Guide, ABOS Marine black Book) are often used to determine market value.

Agreed Value: Determined and agreed upon by both owner and insurance underwriter at the time the policy is purchased.

Bind: To start coverage by accepting the quotation offered and meeting the special conditions and agreeing on a date to start coverage.

Binder: Immediate, temporary coverage or proof of insurance until a policy can be issued. Usually good for a 30 day term.

Constructive Total Loss: C ost of a boat’s recovery and repair exceed the insured value.

Cruising Area: The geographic area or waterway where the boat is used as defined on the policy. If the boat is taken outside this cruising area, a cruising area extension is required to continue coverage.

Cruising Area Extension: Required when boat is taken outside the cruising area defined on the policy. Prior notification and approval is required and a fee will apply based on the length of the extension.

Damage Avoidance: Loss prevention, preparation that prevents or minimizes a loss.

Deductible: The portion of a claim to be paid out of pocket. The higher the deductible, the lower your insurance premium will be.

Depreciation: measured decrease in value of the boat, parts and equipment due to age and condition.

Hull ID: Series of letters and numbers uniquely identifying an individual boat.

Loss Payee: The person and or institution paid in a claim settlement, appearing on the boat’s title.

Named Insured: The person or person(s) whose name appears on the insurance policy.

Named Storm: Tropical storm or hurricane as designated by the National Oceanic & Atmospheric Administration (NOAA).

P & I (Protection & Indemnity): Coverage for third-party property damage, bodily injury, or death caused by you or your boat for which you’re found legally liable.

Partial Loss: Any claim incurred that has not resulted in the total loss of the boat.

Salvage: Successful rescue of insured boat from a perilous or dangerous situation.

Wreck Removal: Remove and dispose of the remains of an insured boat when legally required.

MORE ARTICLES ON MARINE INSURANCE

- Latent Defects: A Little Understood Term Results in Boat Owners Not Taking Advantage of Insurance Coverage

- The Seven Seas Cruising Association has a lot of information on insurance, so be sure to check in with them.

Yacht Insurance Shopping Considerations

Most yacht insurance policies are for an “agreed-upon” value. That is, if there is a total loss, then you are paid the “agreed-upon value” with no deductions. Beware of the tricky “actual cash value” policies wherein the underwriter can deduct substantially for depreciation and other reasons. See our interview with yacht insurance company, Hanham Insurance Agency , in which Hugo Hanham-Gross explains ACV policies’ risks in more detail.

- Always buy an “All Risk” policy (vs. a “Named Peril” policy). Some policies exclude coverage in areas like the Bahamas, Florida, and Caribbean and will require you to take the yacht out of the hurricane belt during hurricane season for named and numbered storms and it can be very restrictive. However, companies like our recommended marine insurance companies will cover your yacht with relatively low deductibles.

- Beware of “exclusions” and “clauses” that allow the insurer to disallow payment.

- You will need “Consequential Damage” coverage that will cover losses that often start with a failed part. Unfortunately, many “sinkings” occur at the dock when some small part below the waterline fails like hoses, stuffing boxes, and sea strainers due to corrosion or wear and tear. This is considered a “lack of maintenance” issue, so you won’t be paid for the hose or sea strainer and some policies won’t cover the sunken yacht either as they exclude any “consequential” damage as a result of wear, tear, and corrosion.

- Some policies only pay the cost of cleaning up a fuel spill if it occurs due to a “covered loss.” So if your sunken boat wasn’t covered because of a failed part, the resulting fuel spill won’t be either. Sometimes fuel spill coverage is subtracted from other liability payments. A better policy separates out fuel-spill liability and provides coverage up to the maximum amount you can be held liable for under federal law, which currently is $854,000.

- In every hurricane, yachts drag and get blown off their moorings and need to be salvaged. Retrieving the yacht may require cranes, travel lifts, and other heavy equipment costing hundreds of dollars per foot of boat length. However, some policies subtract the money paid to salvage the boat from what you get paid to fix the boat, while others only offer salvage coverage up to 25% or 30% of the insured value. Look for separate salvage coverage up to the insured value of the boat in addition to any payments to fix the boat or replace equipment.

- If your boat gets destroyed completely by fire or some other reason, you end up with a “wreck.” Most insured yacht owners assume their policy will cover the cost of cleaning up what’s left, but some policies will give you a check for the insured value and only a specified percentage for wreck removal – 3% to 10% – nowhere near enough for the clean-up job. Better policies pay up to the liability limit, usually $100,000 or more.

There are other things to look out for like dinghy coverage, medical coverage, trip interruption, liability, and more. But generally, the above mentioned are the “tricky” parts and you should make sure that you understand each clause.

Estelle Cockcroft

Join our community.